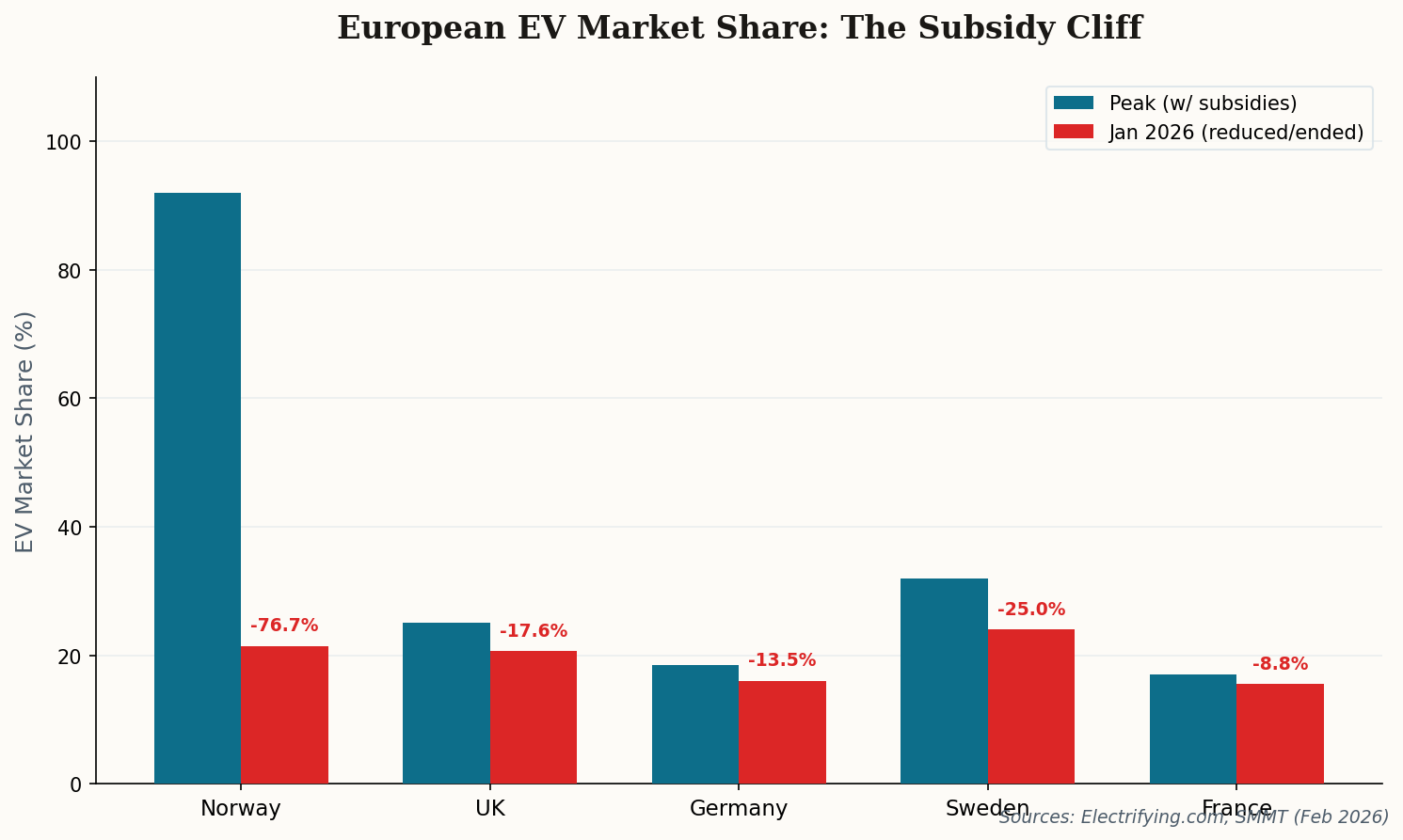

Europe Proves EVs Still Run on Subsidies

Norway — the world's poster child for EV adoption — just had its car market implode. New car registrations plummeted 76.7% in January after the government trimmed purchase incentives. Let that sink in: the country where EVs once held over 90% market share saw total car sales collapse almost overnight. This isn't a blip. It's the sound of a market that was artificially inflated by government subsidies exhaling for the first time.

The contagion isn't limited to Oslo. Across the English Channel, UK battery electric vehicle growth stalled at a pathetic 0.1%, with market share slipping to 20.6% — its lowest since April 2025. Germany and Sweden, reading the room, rushed to introduce new targeted incentives for 2026 to prevent their own free falls.

Here's the uncomfortable truth: outside of China, there is not a single major market where EV adoption has proven it can sustain itself without government life support. Every time a subsidy ends, sales crater. Every time a new one launches, sales spike. We're not witnessing an organic technology transition — we're watching a policy-dependent market react to the presence or absence of taxpayer money. Manufacturers planning production volumes around these numbers are essentially betting on the political calendar.