The Ladder Is Real—But the Rungs Are Disappearing

Here's a paradox that should keep policymakers up at night. A landmark NBER study by Raj Chetty and colleagues proves that revitalizing public housing—specifically through the HOPE VI program—actually works. Children relocated to high-opportunity neighborhoods showed measurably higher college attendance rates and lower incarceration. The ladder exists. Climb it and your life genuinely changes.

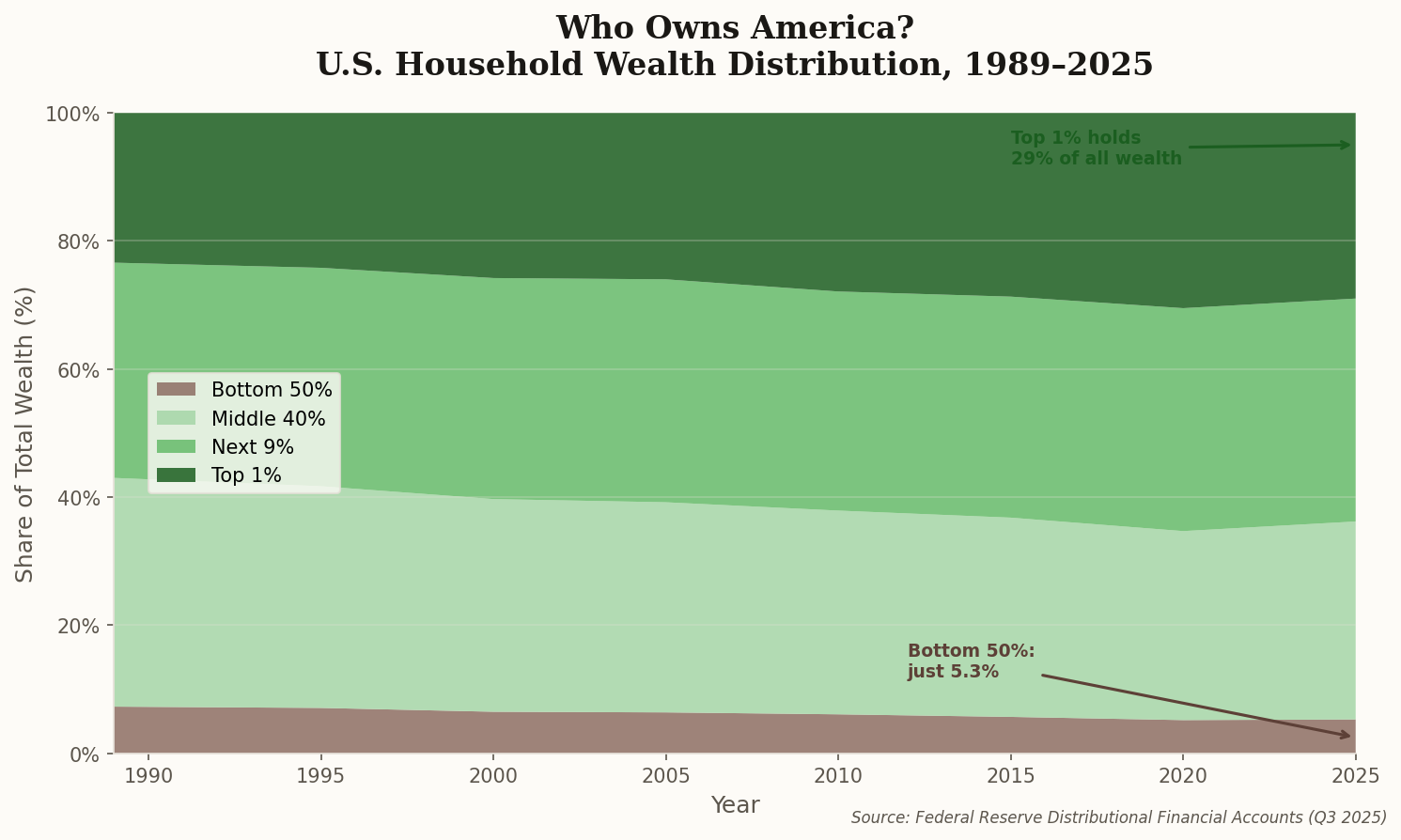

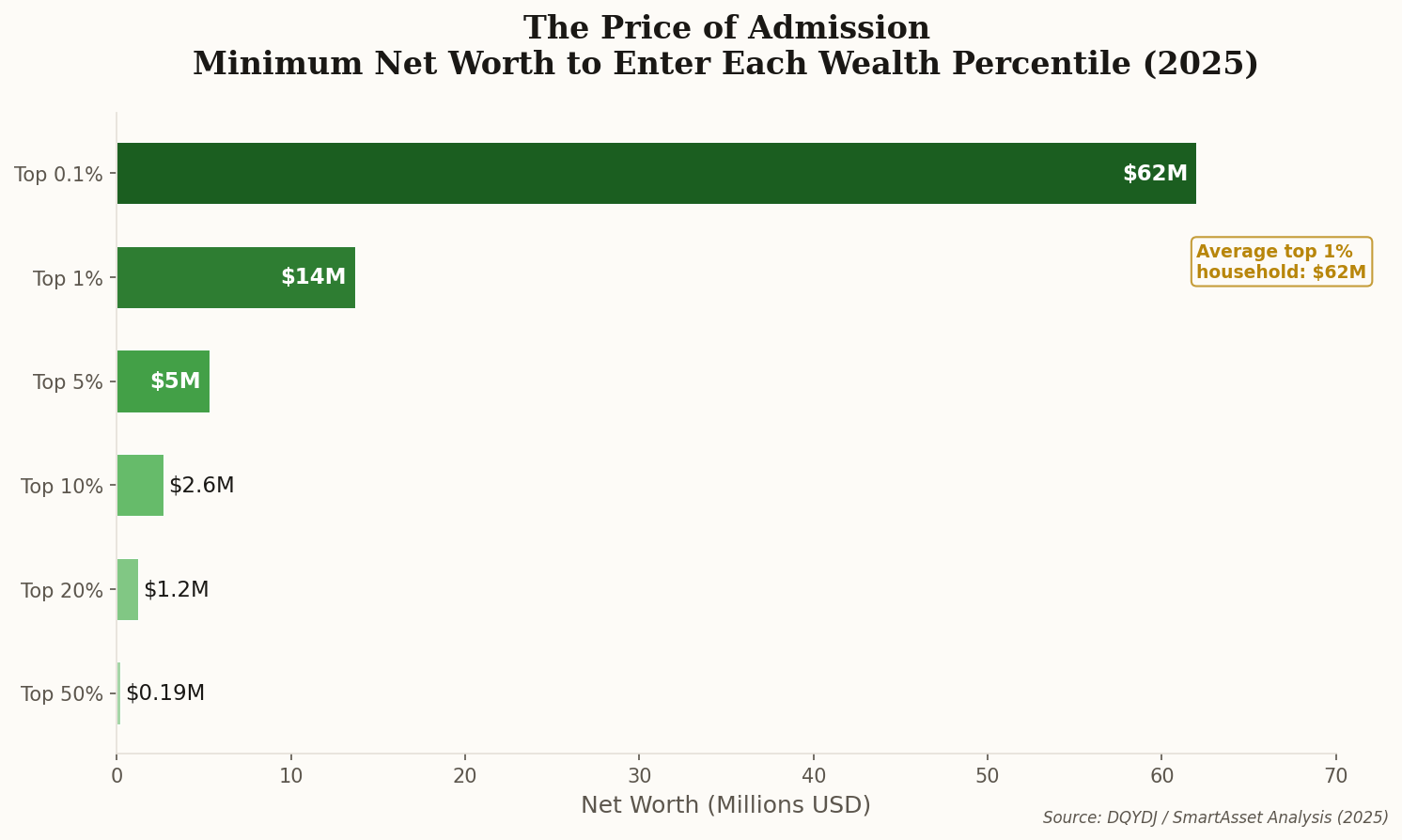

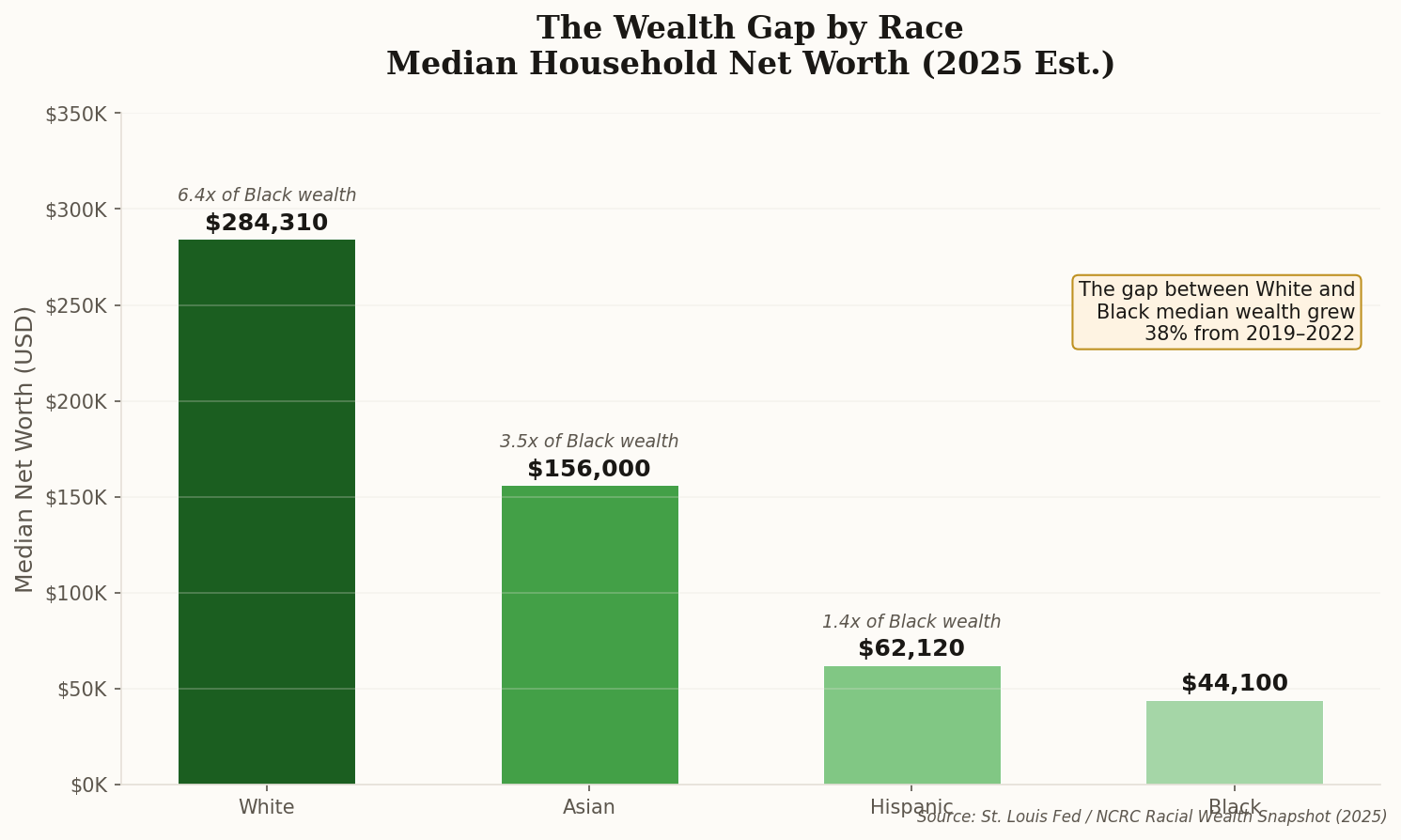

But here's the problem: the broader data shows the ladder is getting shorter. Brookings research from 2025 confirms that intergenerational mobility is declining across the board, with wealth transfers increasingly determining economic status over merit or income. Translation: where you start matters more than what you do. The American Dream isn't dead—it's just becoming a hereditary privilege, passed down like silverware.

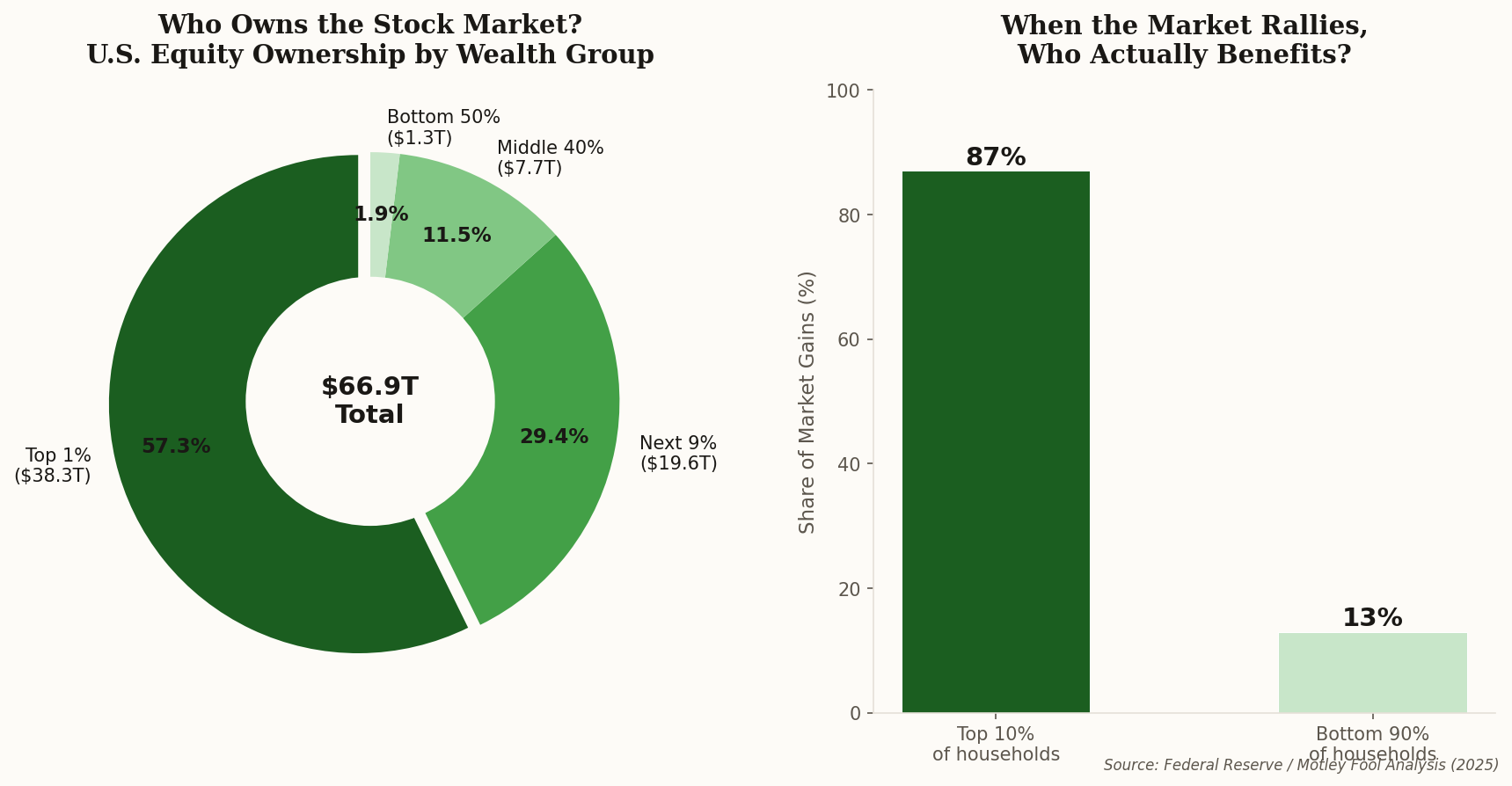

The tension: We know how to create upward mobility at the neighborhood level. But the structural forces pulling in the opposite direction—asset concentration, declining real wages, education costs—are overwhelming those interventions at scale. Policy works. It just can't keep up.

What this really means is that the 1% debate isn't about envy. It's about whether we're building a society where the destination is determined at birth. Chetty's data says we can intervene. Everything else says we're choosing not to.