Thailand's Tax Trap Remains Unsprung

Here's the scenario every Thailand-bound retiree dreads: you've sold the house, wired the proceeds, and now the Thai Revenue Department wants a cut of your life savings. That's been the fear since January 2024, when Thailand started taxing all remitted foreign income—regardless of when you earned it.

A proposed Royal Decree would fix this by exempting income remitted more than 12 months after being earned. Sensible policy. But here's the problem: Thailand's February 8th general election has frozen all legislative action. The decree sits in limbo while expats play the waiting game with their accountants.

The bottom line: If you're planning to move to Thailand in 2026, treat the 2024 rules as gospel until a new government says otherwise. That means potential tax liability on any foreign income you bring in. Structure accordingly.

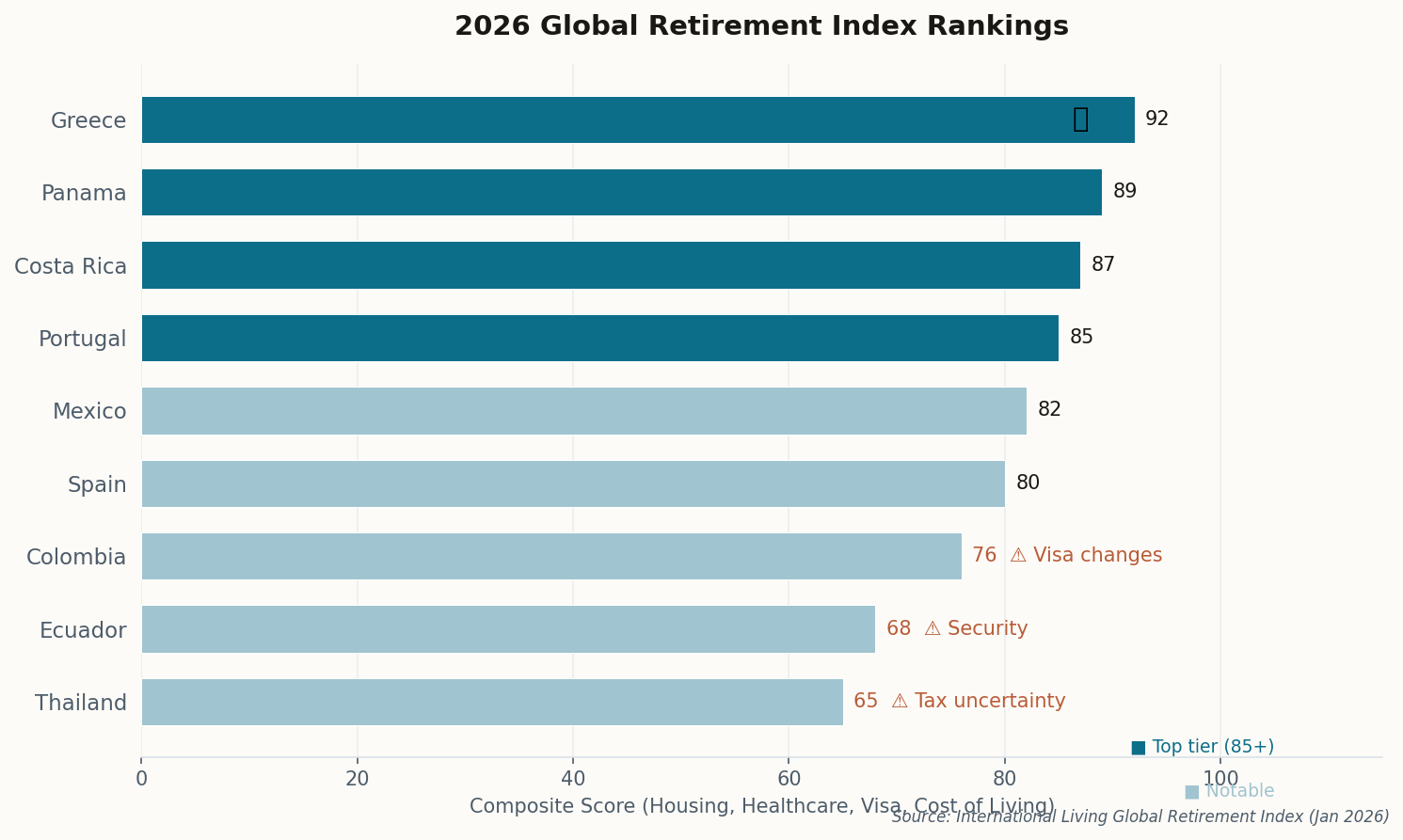

What makes this particularly maddening is that Thailand remains one of the most affordable places for American retirees. A comfortable lifestyle in Chiang Mai runs $1,500–2,000/month. But tax uncertainty turns a straightforward decision into a spreadsheet nightmare. Watch for movement after the election; the new government will need to address this quickly or risk losing the expat money they've been courting.