Seven Point Six Billion Reasons This Isn't a Fad

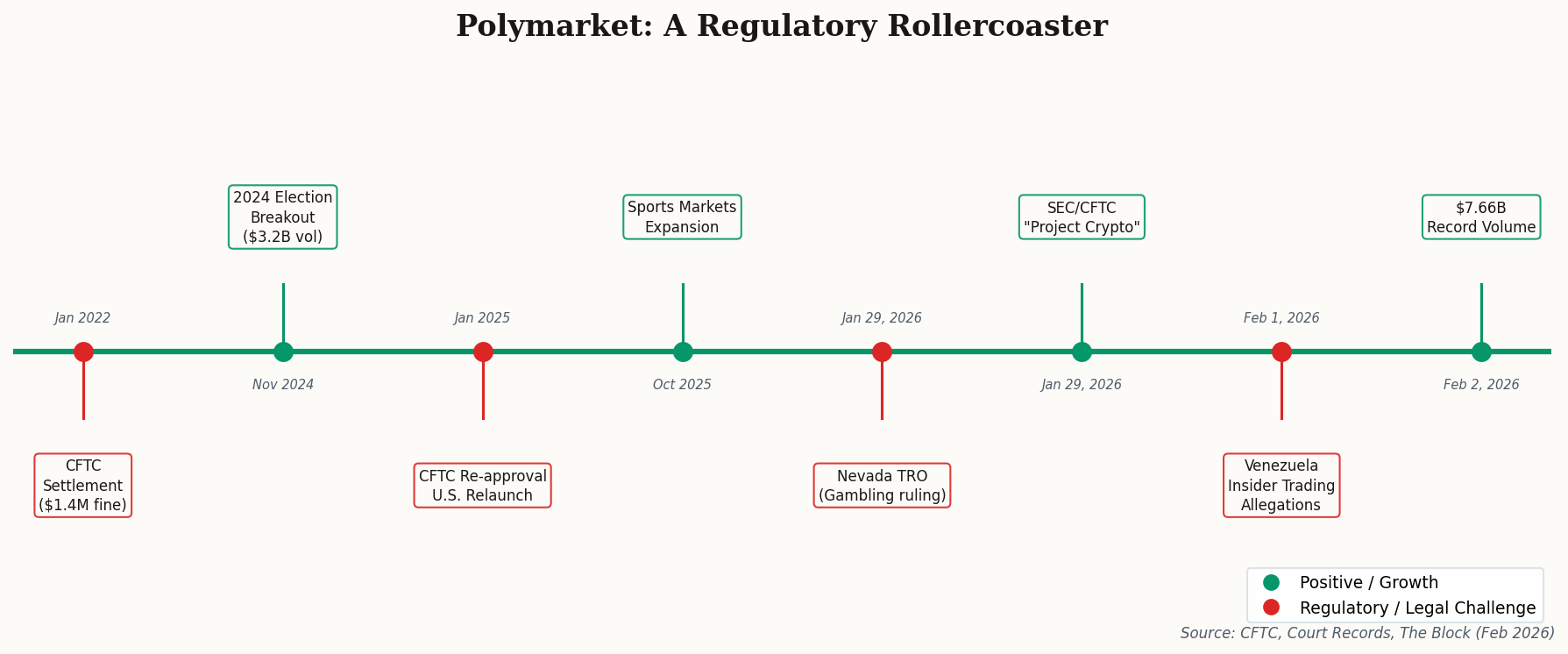

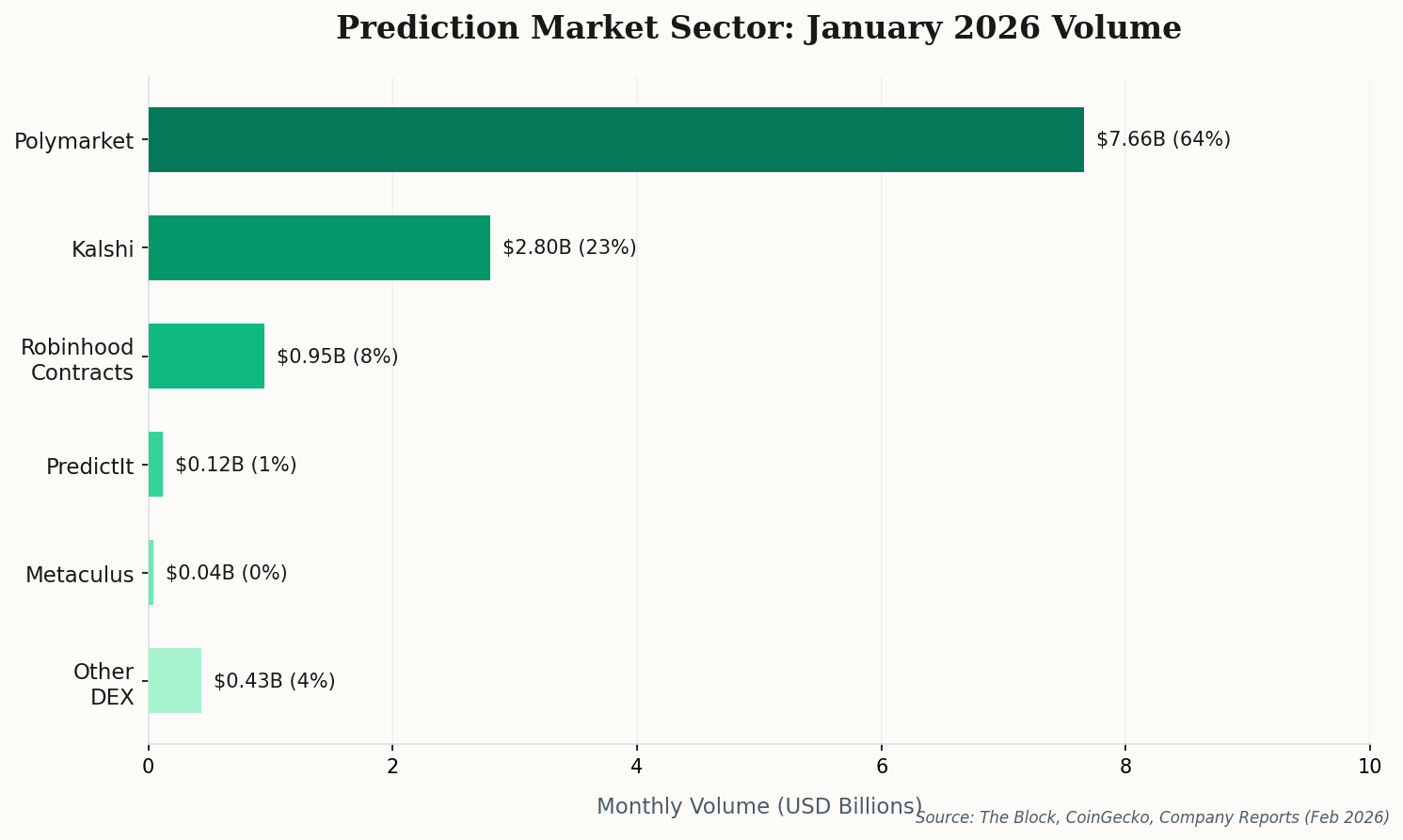

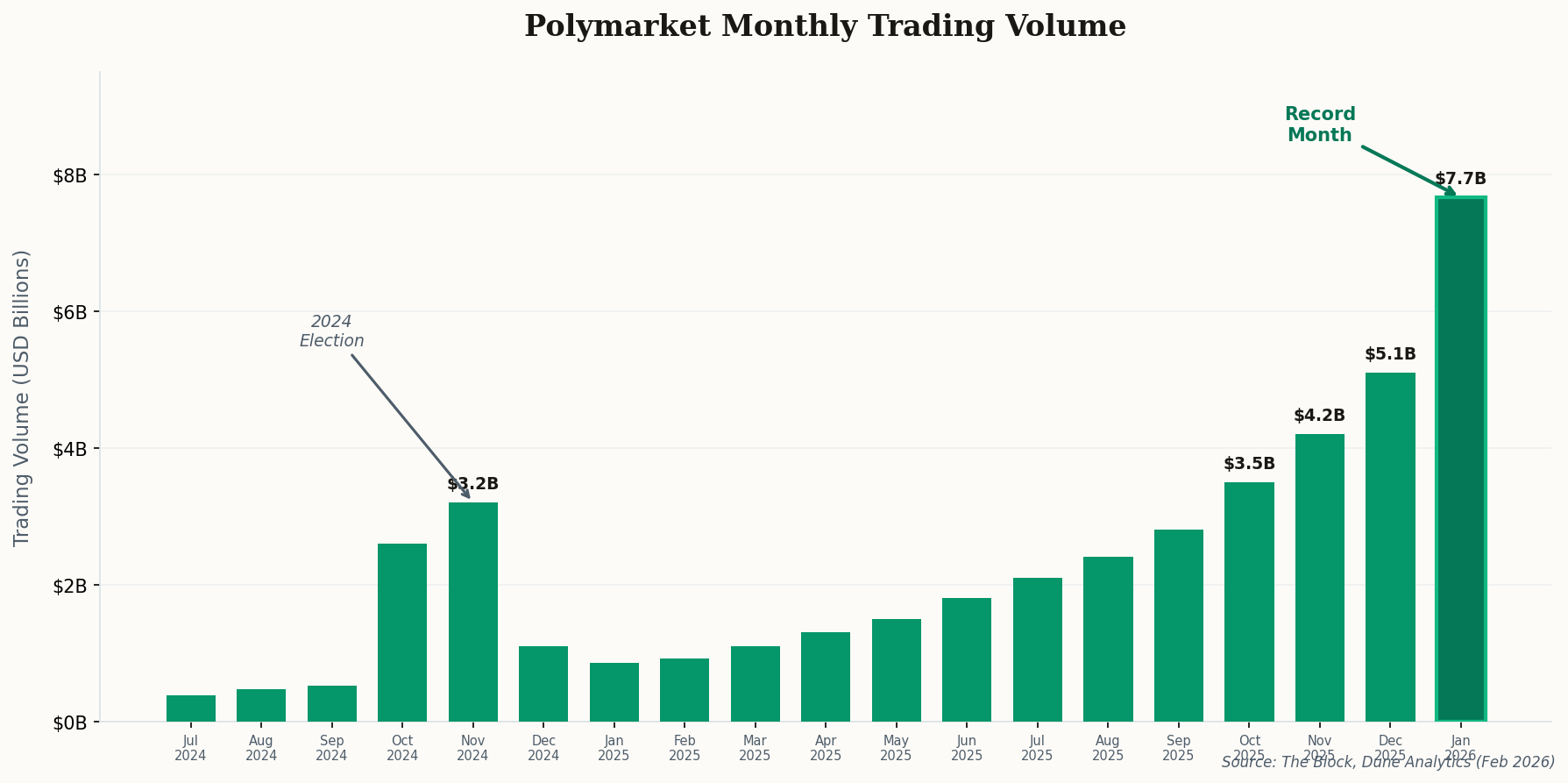

Here's a number that should make every traditional exchange executive lose sleep: $7.66 billion. That's Polymarket's trading volume for January 2026 alone, driving the entire prediction market sector past $12 billion. For context, that's more monthly volume than the CBOE's VIX futures handled in most months of 2024.

The platform generated $2.62 million in on-chain fees for the month—not spectacular by crypto standards, but the volume-to-fee ratio tells you something important: Polymarket is competing on liquidity depth, not extraction. This is the playbook of a platform that thinks it's building infrastructure, not running a casino.

What's driving the surge? Three things: the platform's regulated U.S. relaunch after its CFTC settlement, a geopolitical calendar that reads like a Tom Clancy novel, and a generation of traders who grew up treating prediction and speculation as the same verb. The question isn't whether people want to bet on world events. It's whether we call it "investing" when the house is a smart contract.