The Rulebook Finally Catches Up to the Robots

You can build the most sophisticated humanoid robot on the planet, but if there's no safety standard that accounts for a two-legged machine walking around a factory floor, you're not deploying it anywhere that matters. The Association for Advancing Automation (A3) just released Part 3 of the updated ANSI/A3 R15.06 national safety standard, and it's the first time a major regulatory body has explicitly addressed what happens when robots stop being bolted to the floor.

The update shifts focus from how robots are designed to how they're actually used — day-to-day integration of robot cells, not just theoretical compliance. But here's the tension: existing ISO standards were written for stationary industrial arms. Humanoids that walk, balance, and make real-time decisions in shared human spaces require entirely new "dynamic safety models" that nobody has fully defined yet. The standard acknowledges this gap without completely filling it.

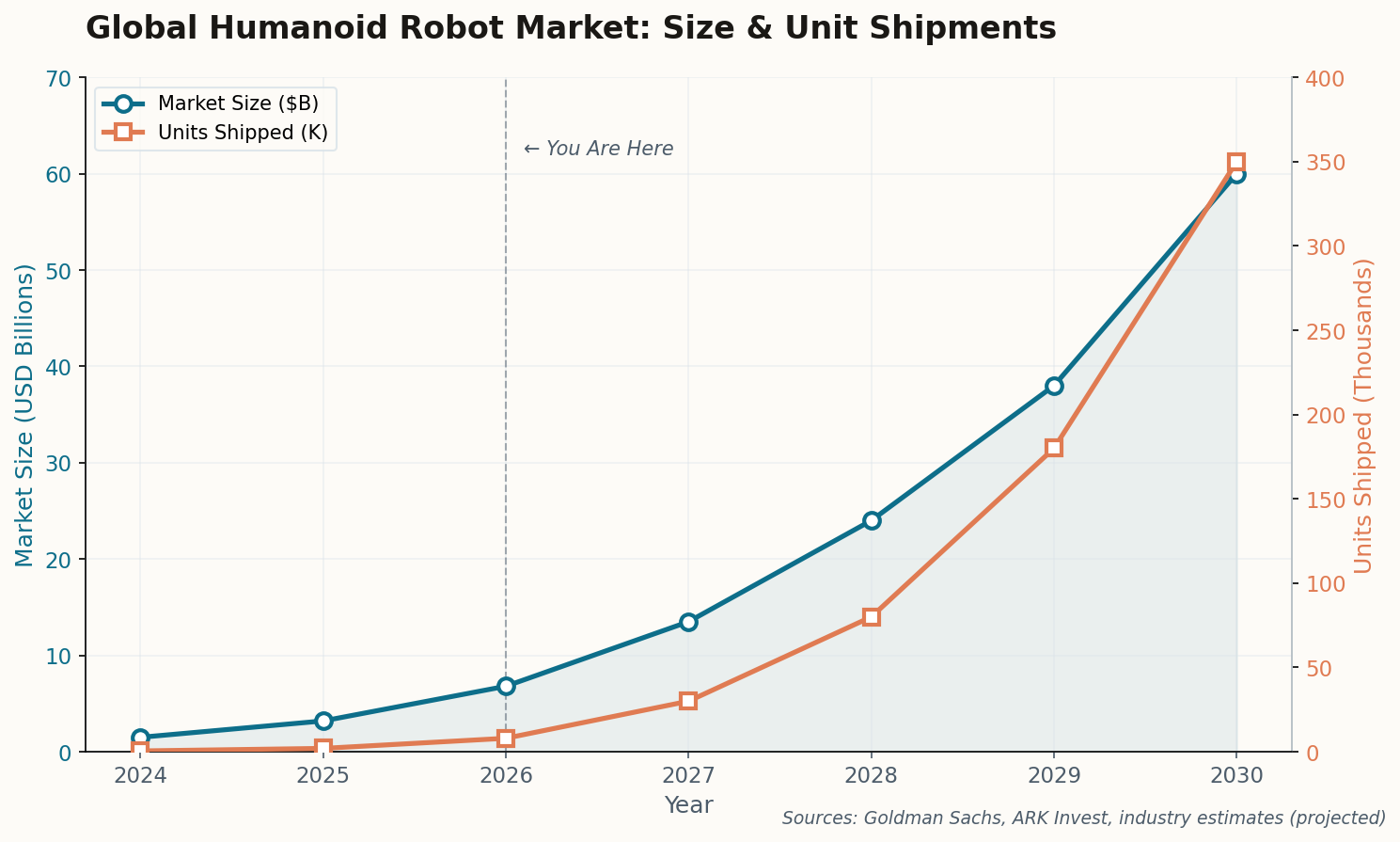

Why this matters more than it sounds: every company in this newsletter — Tesla, Figure, Boston Dynamics, all of them — needs regulatory clarity before they can scale beyond pilot programs. This standard doesn't solve everything, but it gives insurers, factory operators, and procurement teams a framework to say "yes" instead of "let's wait." Expect the EU's machinery regulation update to follow within months.