The Privacy Moat Just Got a Six-Month Stress Test

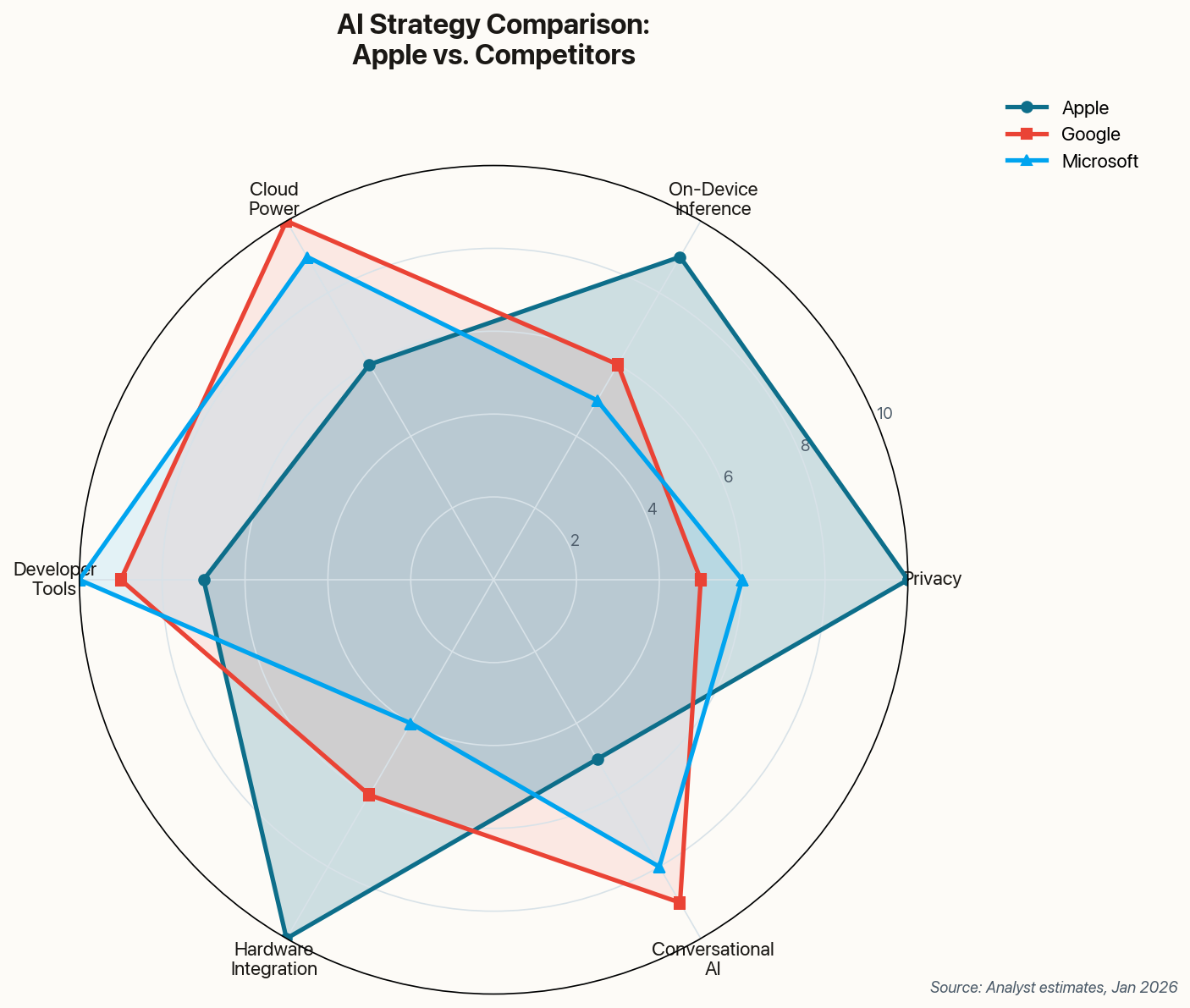

When Apple launched Private Cloud Compute last year, skeptics assumed it was marketing theater—a clever story to tell regulators while the real compute happened on Google's servers. They were wrong.

Security researchers just completed a six-month stress test of PCC infrastructure. The verdict: no significant vulnerabilities that would allow Apple or third parties to access user data. This isn't a trivial claim. It means Apple has built the only cloud AI implementation that cryptographically guarantees the provider cannot see what's being processed.

Key insight: PCC is effectively an extension of your iPhone, just running on Apple Silicon in a data center. The encryption keys never leave your device.

Why does this matter? Because enterprise adoption of AI hinges on trust. Healthcare systems won't run patient data through cloud AI unless they're certain of confidentiality. Legal firms won't summarize privileged documents on servers that might be subpoenaed. Apple just validated that their solution passes the most demanding security bar in the industry. That's not "late to AI"—that's building infrastructure competitors don't have.