Trump Media's Wild Ride: From $34 to $10 to... Fusion Energy?

Here's a question for the ages: What happens when a social media company with negligible revenue proposes a $6 billion merger with a fusion energy startup? If you're Trump Media & Technology Group, you issue a press release and watch the stock jump.

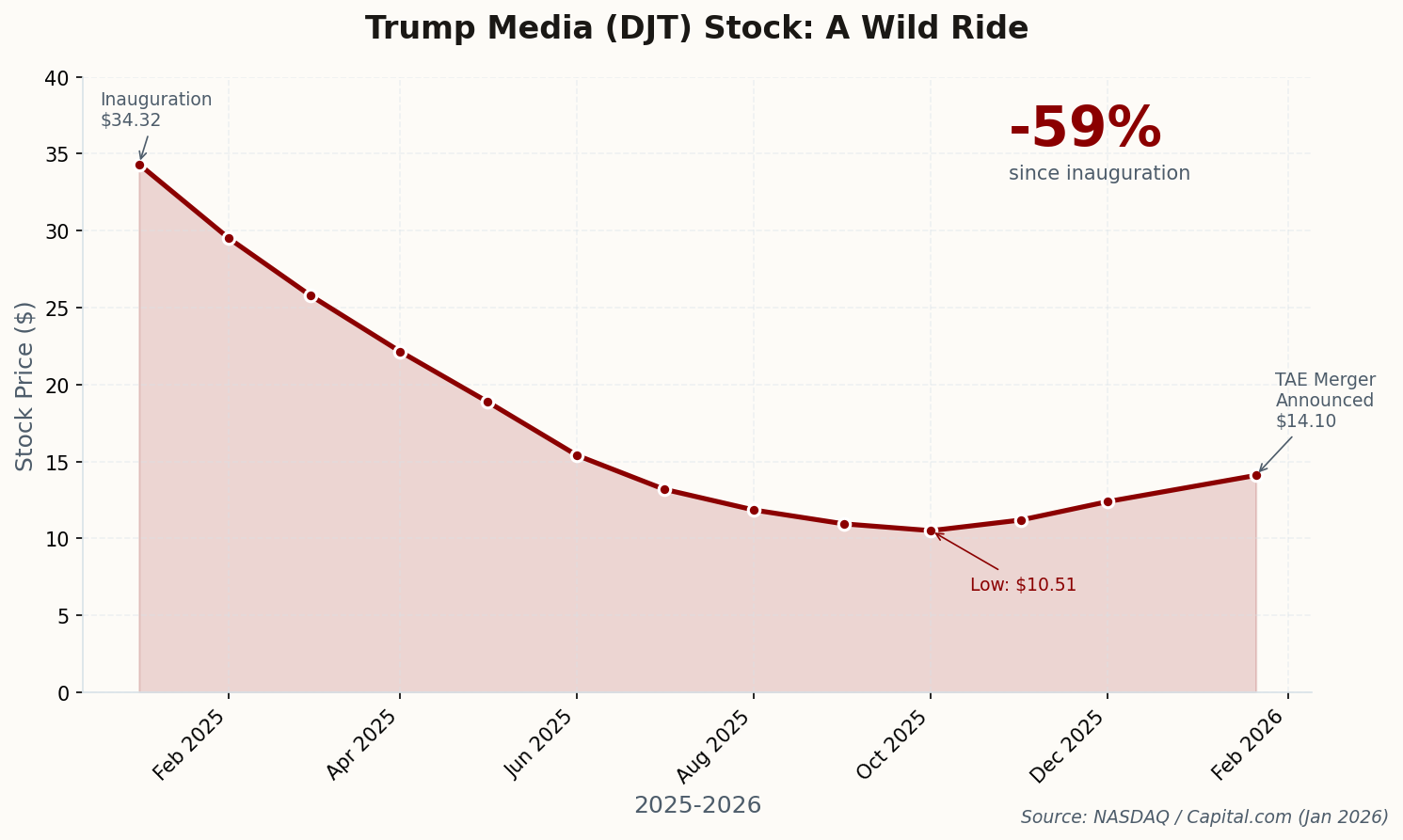

The numbers tell a brutal story. DJT stock opened Trump's second term at $34.32. By December, it had cratered to $10.51—a 69% decline that would normally signal a company in crisis. But Trump still holds 52.1% of the company, including 36 million "earnout shares" that vest based on stock performance thresholds. The proposed merger with TAE Technologies sent shares rebounding to $14.10, though analysts remain skeptical about the strategic rationale of combining a struggling social network with experimental fusion research.

The insider trading data is particularly telling. Corporate insiders sold 1.43 million shares while purchasing 2.05 million in 2025, giving the company a negative "Insider Power Score" of -55.83. In plain English: the people who know the company best aren't exactly betting the farm on its future.

Why it matters: Whether DJT's valuation reflects business fundamentals or simply the betting market on Trump's political fortunes is a question the SEC seems uninterested in asking. The merger proposal, if approved, would value a company with $4 million in quarterly revenue at $6 billion—a multiple that only makes sense if you're pricing in something other than software.