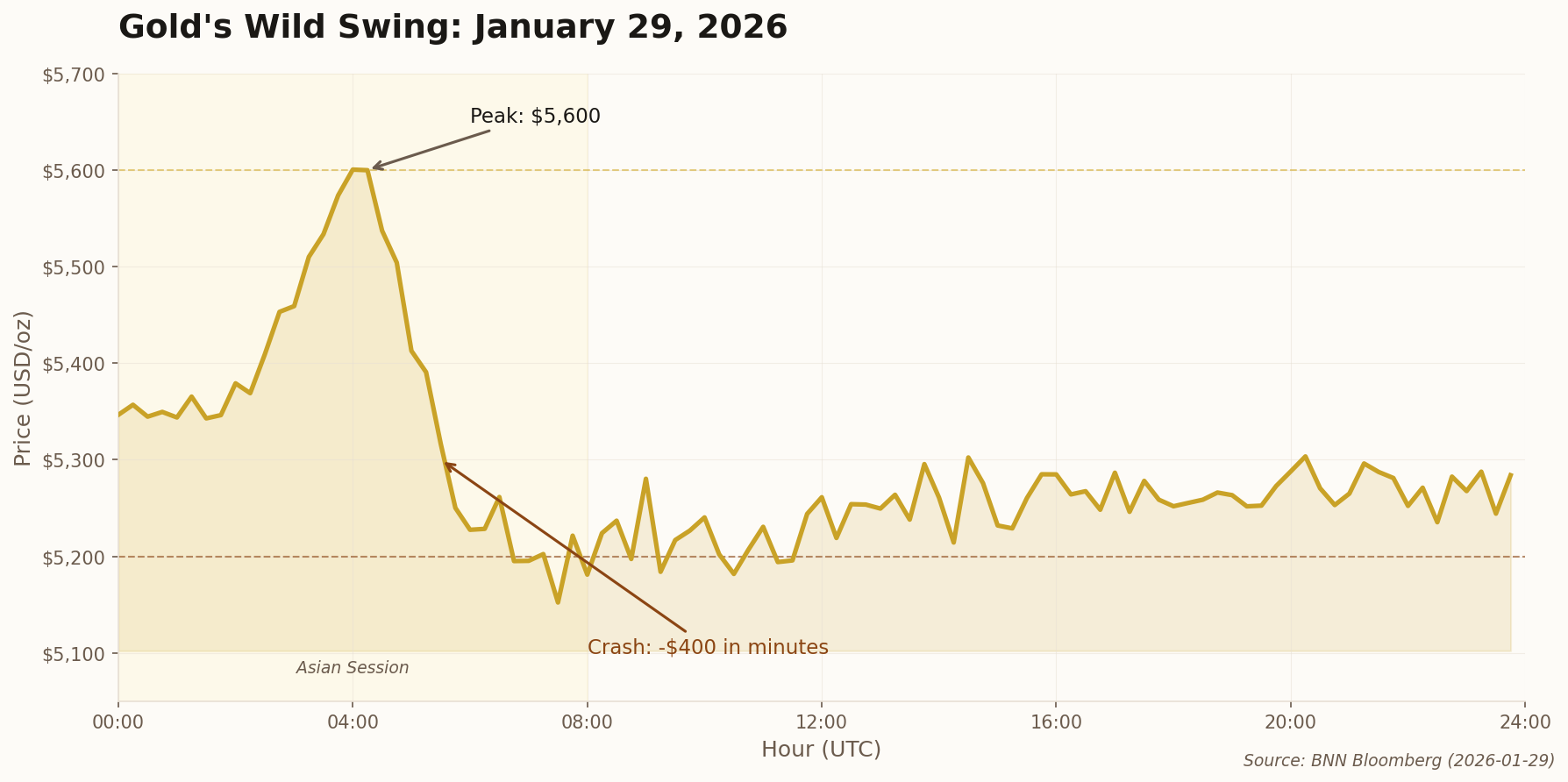

Gold's $400 Rollercoaster: Blow-Off Top or Just Getting Started?

In the early hours of Asian trading, gold did something extraordinary: it ripped from $5,500 to nearly $5,600 in minutes, then crashed $400 in what traders described as "rapid and disorderly." The metal now sits below $5,200, having given back weeks of gains in a single session.

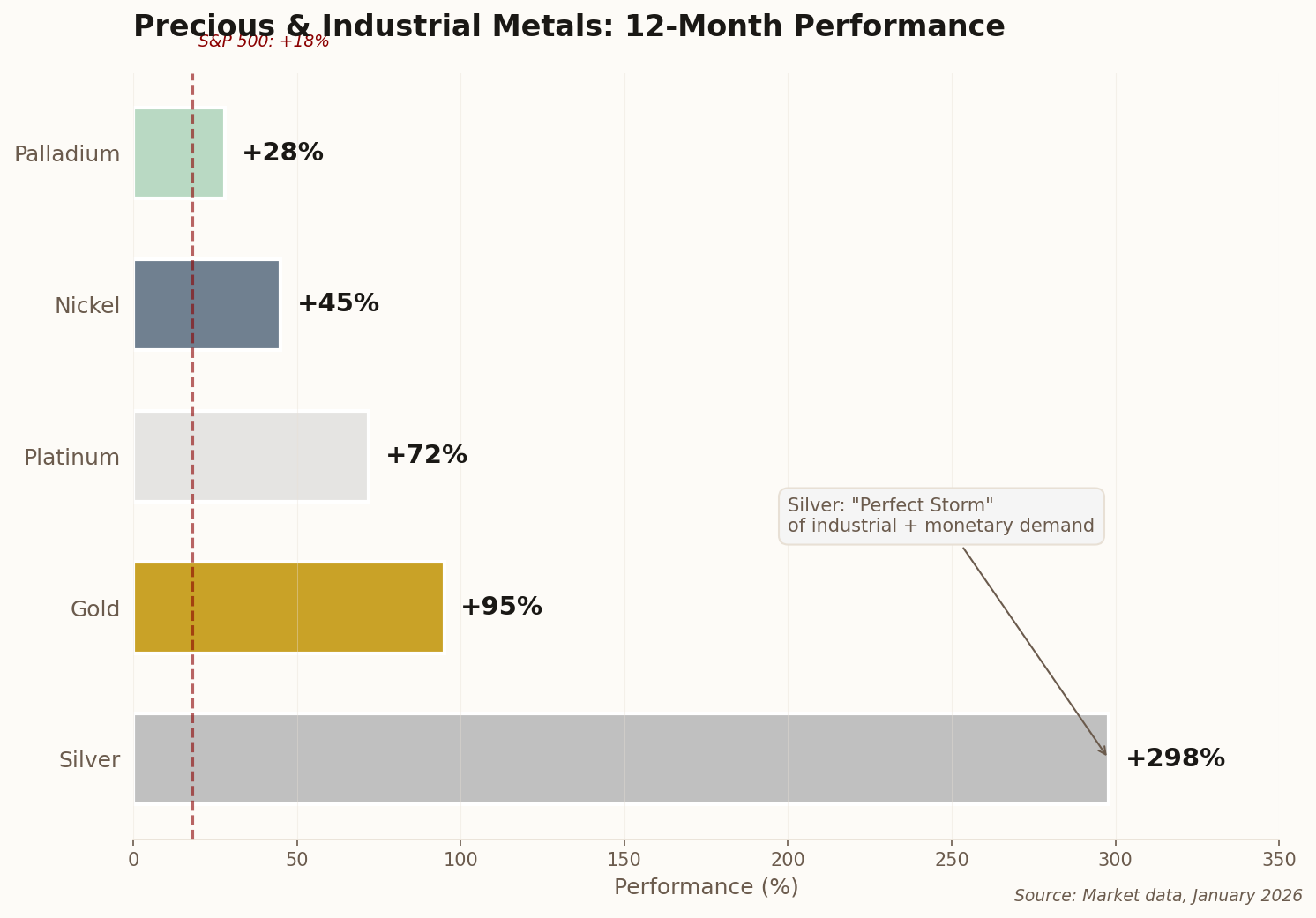

This kind of intraday violence has a name: blow-off top. It's what happens when a parabolic move—gold has nearly doubled in twelve months—finally exhausts the last wave of momentum buyers. The question isn't whether this is volatility. The question is whether it's the end or merely a pause before the next leg.

The fundamentals remain unchanged: central banks are still buying. World Gold Council data shows sovereign purchases running at near-record pace, driven by diversification away from dollar reserves. Safe-haven demand amid geopolitical uncertainty hasn't evaporated. But technical traders see a market that's overshot, and profit-taking at these levels is entirely rational.

Watch the $5,000 level. If gold can hold there, this is consolidation before the next move higher. If it breaks, the air below is thin.