The $10 Trillion Shock: Why Your Portfolio Should Care

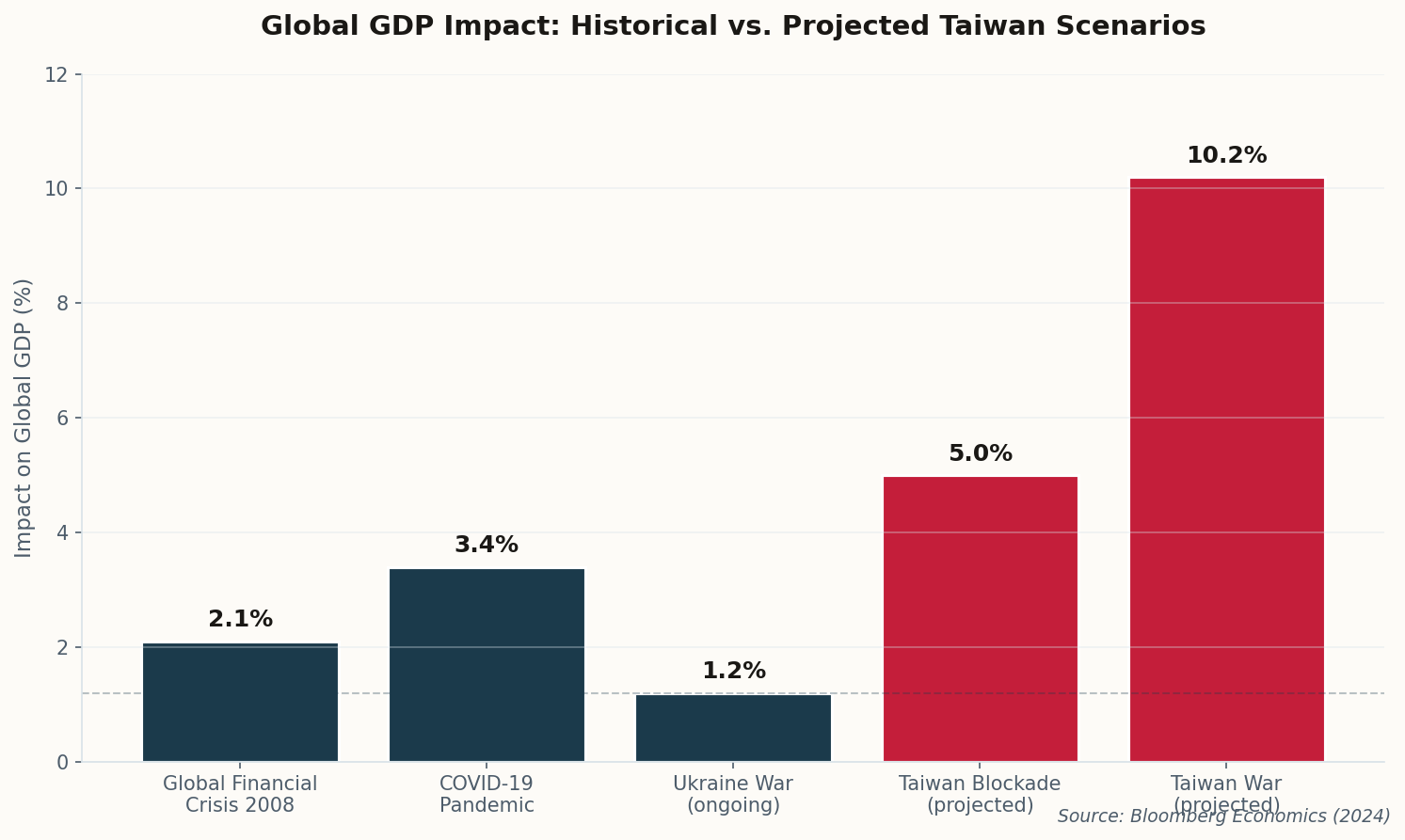

Forget Ukraine. Forget COVID. If China moves on Taiwan, you're looking at an economic crater five times deeper than the 2008 financial crisis. Bloomberg's economists put a number on it: $10 trillion, or roughly 10% of global GDP, vaporized.

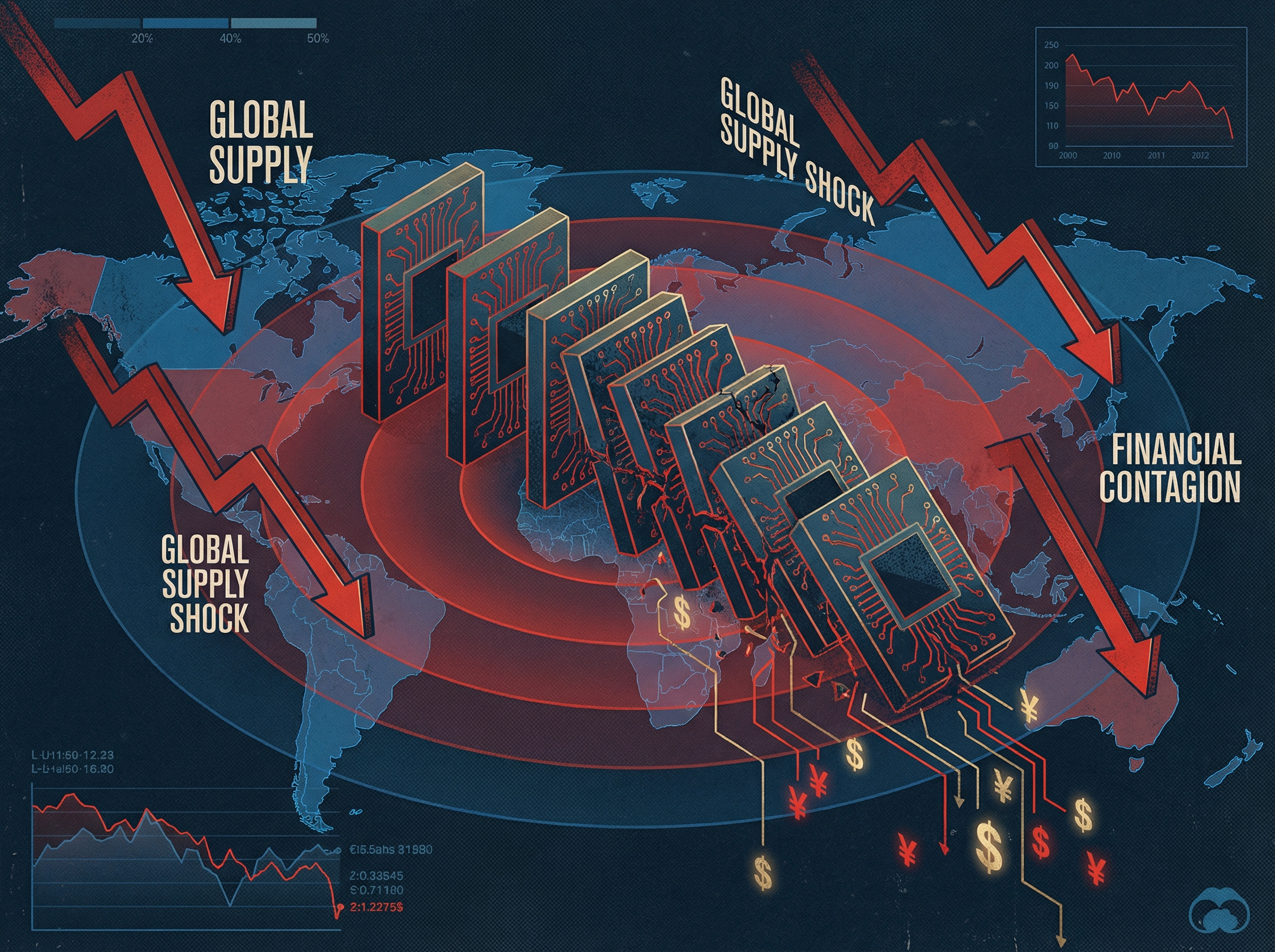

The math is brutal. TSMC produces over 90% of the world's most advanced semiconductors. Every iPhone, every Nvidia GPU, every modern car—all of it flows through a single island 100 miles from the Chinese coast. A blockade alone would cut global GDP by 5%. A shooting war doubles that.

The report models two scenarios: a quarantine that chokes off trade, and a kinetic conflict that destroys production capacity outright. Neither is good for anyone—including China, whose economy would contract by up to 16.7% in the war scenario. This isn't just geopolitics; it's mutually assured economic destruction.

The bottom line: The semiconductor supply chain isn't just a business risk—it's a global systemic vulnerability. Every week that passes without meaningful chip diversification is another week of Russian roulette.