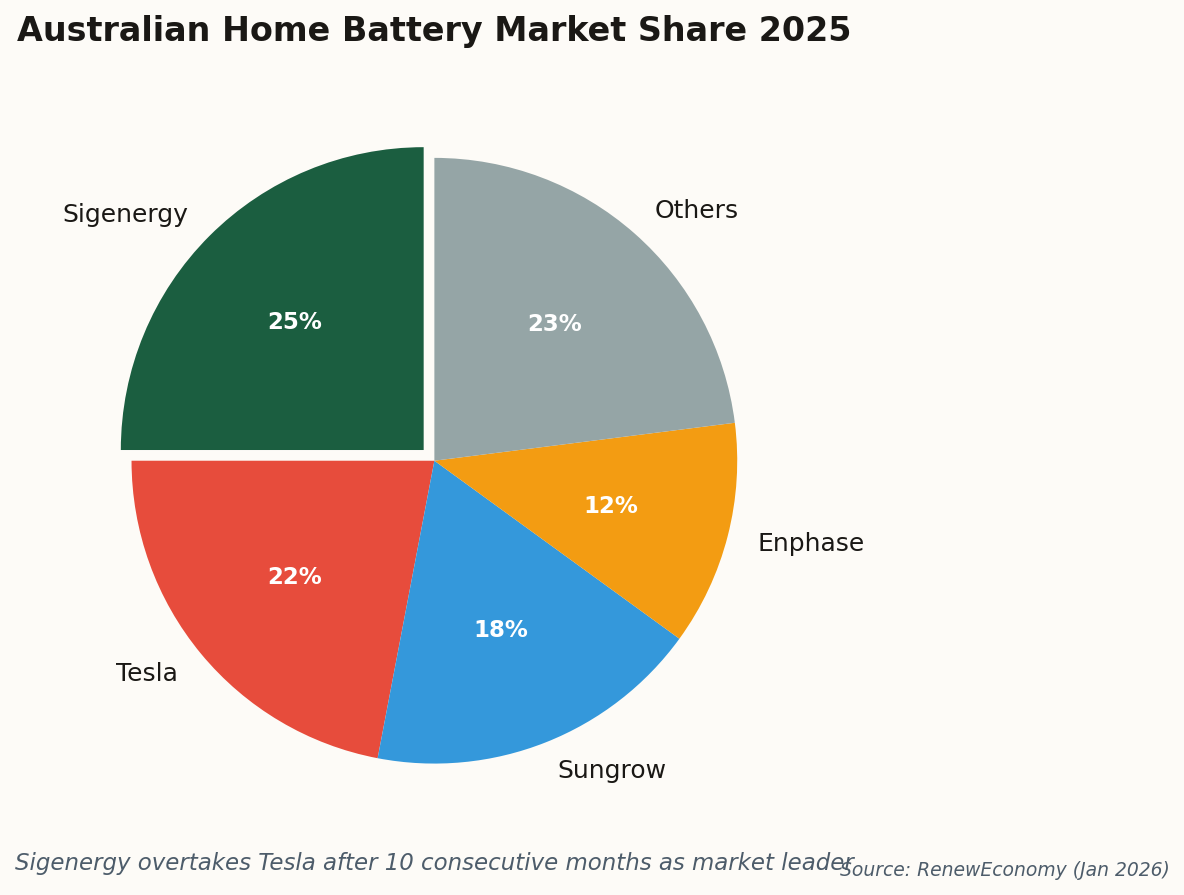

The King Is Dead: Sigenergy Dethrones Tesla in Australia

Tesla's decade-long grip on the Australian home battery market has officially ended. Sigenergy, a Chinese manufacturer most Americans have never heard of, now commands 25% of Australia's residential storage market—surpassing both Tesla and Sungrow after holding the top spot for ten consecutive months.

Why should you care about what happens in the Outback? Because Australia is the world's crystal ball for residential energy storage. With the highest per-capita rooftop solar penetration on Earth and some of the most volatile electricity prices, Australian consumers make buying decisions today that predict what American homeowners will face tomorrow.

Sigenergy's secret? A hybrid inverter architecture that plays nice with any solar panel configuration and doesn't require proprietary ecosystem lock-in. Tesla's walled garden approach—brilliant for vertically integrated EV buyers—is proving less compelling for homeowners who just want their lights to stay on.

The bottom line: If you're shopping for a home battery in the US right now, Sigenergy should be on your shortlist. They're coming for this market next.