The Hype Check: PJM Slashes AI Power Forecasts

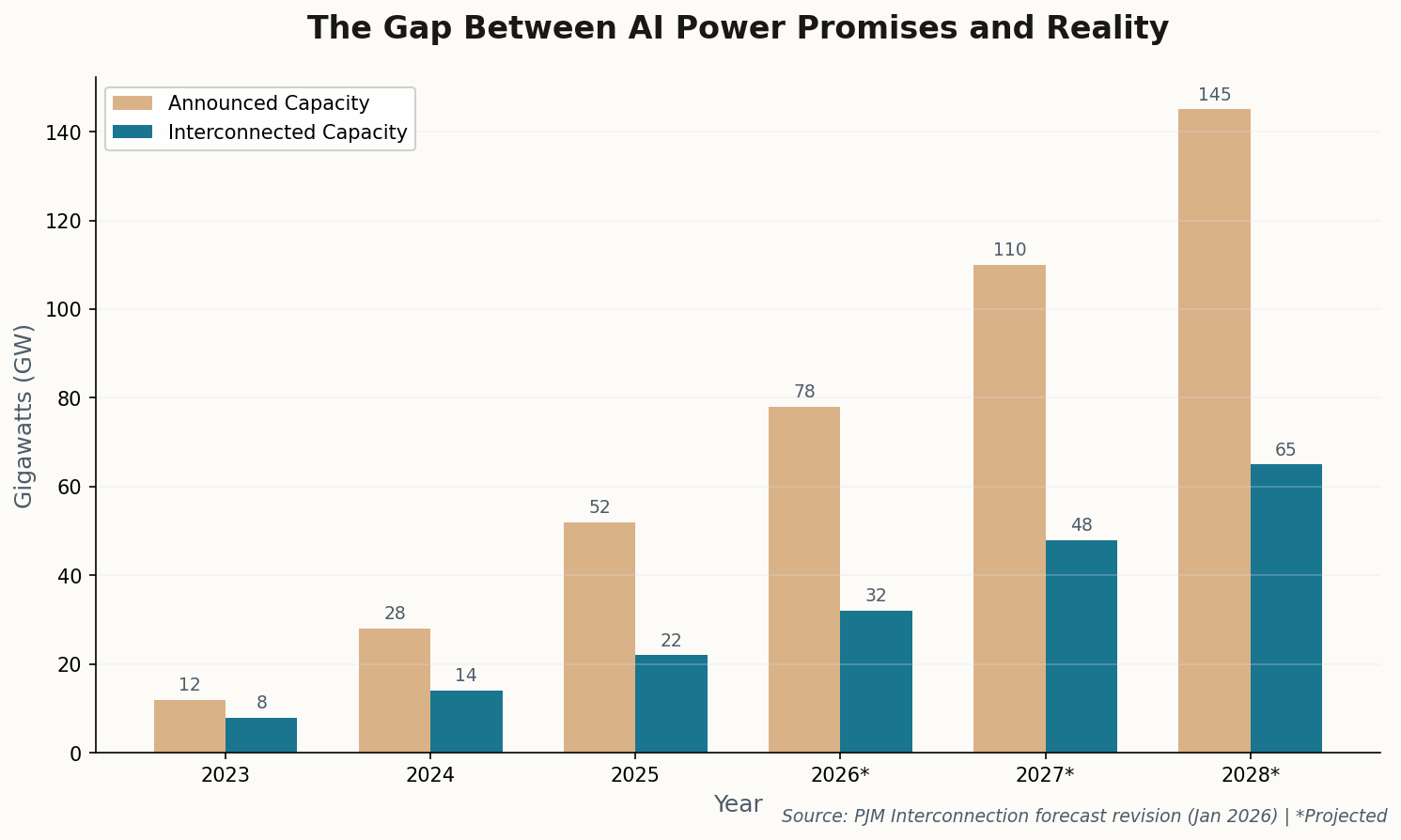

Here's a number that should humble every AI power apocalypse narrative: PJM Interconnection, the nation's largest grid operator serving 65 million people from New Jersey to Illinois, just revised its load growth forecast downward for the first time in two years.

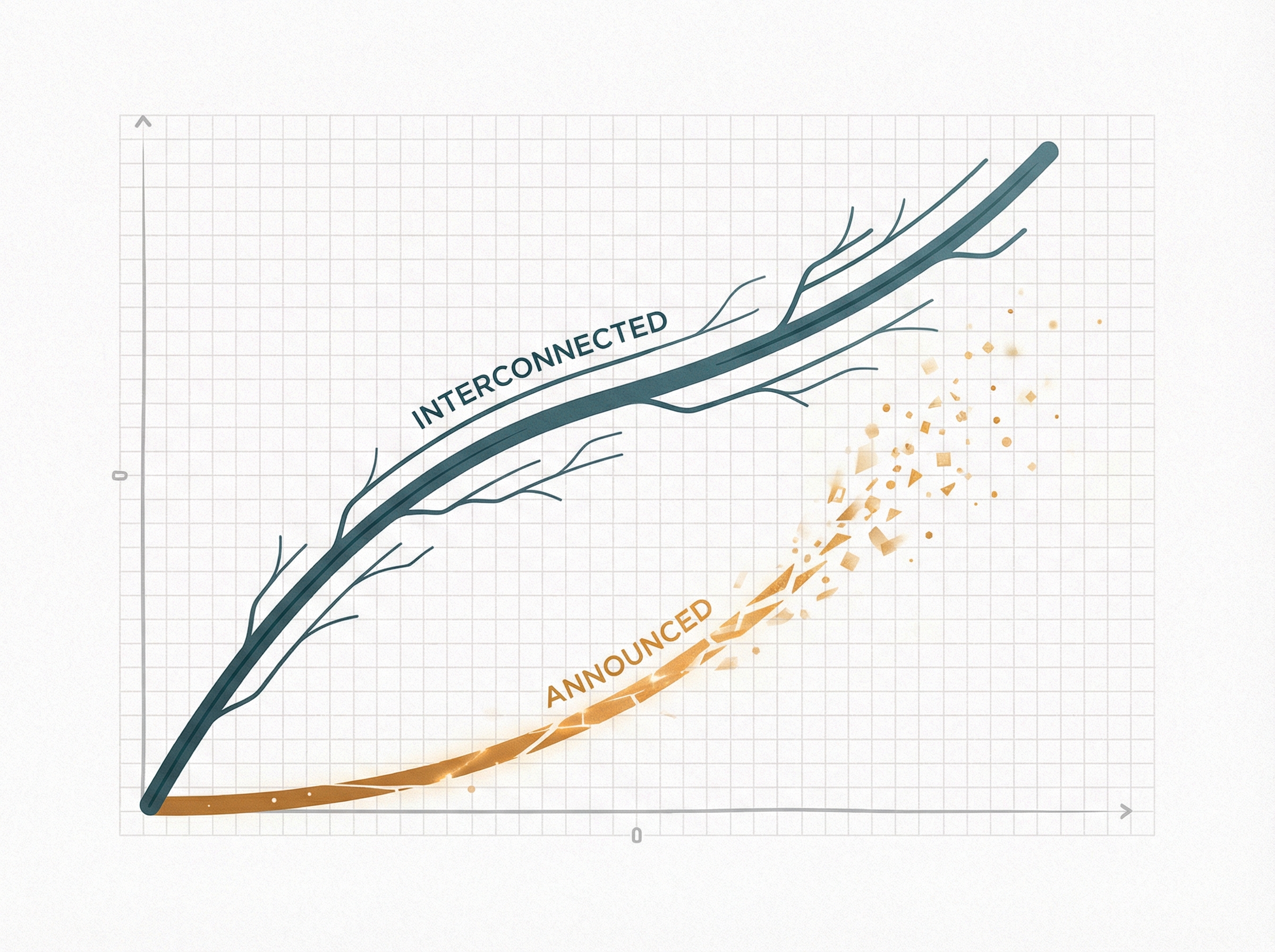

The reason? "A divergence between announced gigawatts and interconnected gigawatts." Translation: tech companies have announced more data center capacity than they can actually build, finance, or connect. Supply chain bottlenecks, financing hiccups, and the sheer complexity of grid interconnection are throttling the AI buildout.

This isn't good news, exactly—the long-term demand trajectory remains steep. But it suggests the "grid collapse by 2027" scenario is overblown. The more likely future: a prolonged, expensive slog where AI expansion proceeds at the speed of permitting, not the speed of venture capital.