Wyoming Takes the Crown as America's Best Retirement State

The cowboy state just lassoed the top spot in Morningstar's 2026 retirement rankings, and it's not because of its beaches. Wyoming won with a triple threat: zero personal income tax, moderate cost of living, and—here's the kicker—the healthiest older adult population in the nation.

That last point matters more than you'd think. Medicare data shows Wyoming retirees have the lowest rates of multiple chronic conditions among beneficiaries. Translation: people who retire there aren't just saving money; they're actually staying healthier longer.

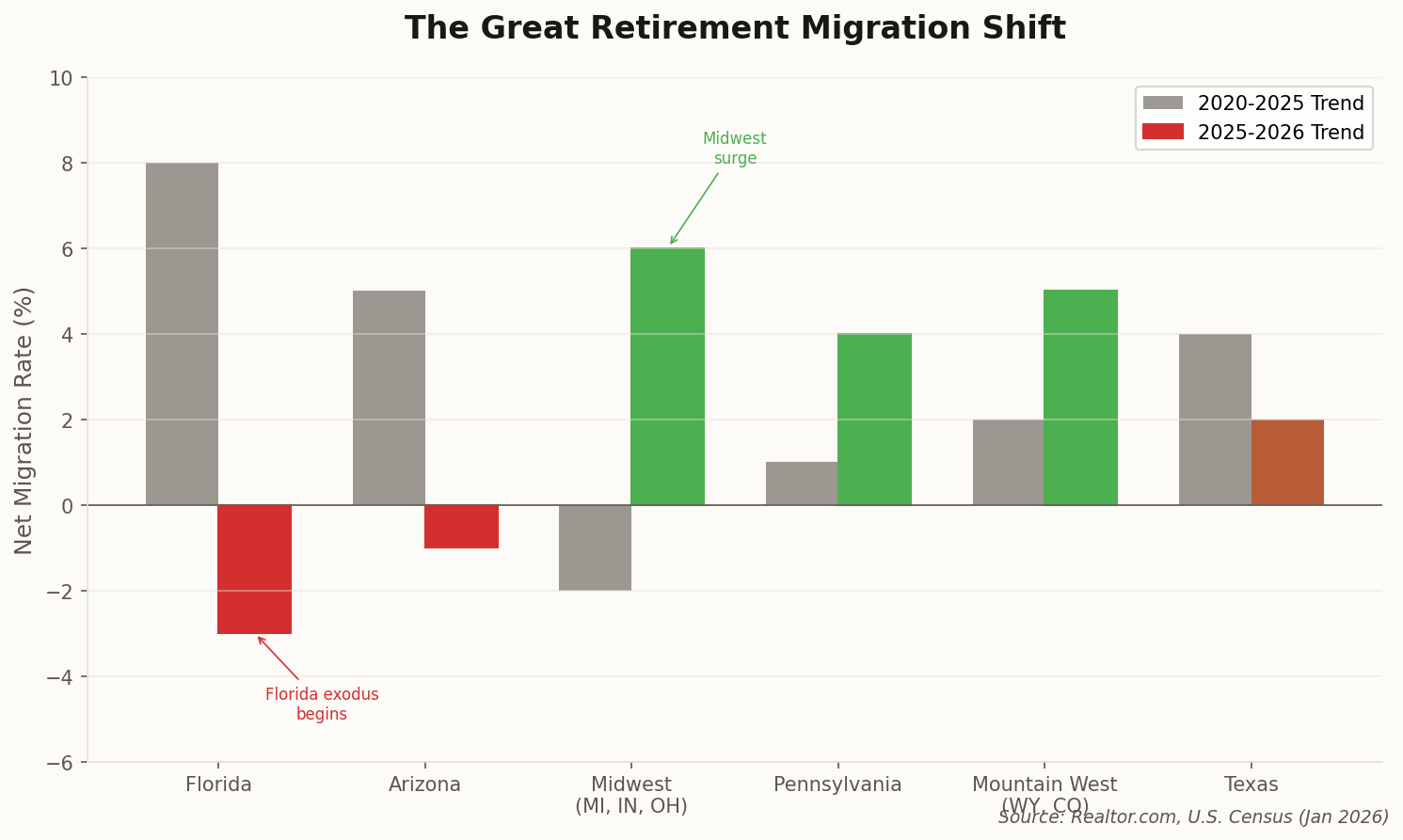

The losers? New Jersey ranked dead last at #50, crushed by high costs and tax burdens. South Dakota, Colorado, and Vermont rounded out the top tier, signaling a clear shift away from traditional "sun and sand" destinations toward tax-efficient, less-crowded states. If your retirement plan still assumes Florida is the default, it's time to recalculate.