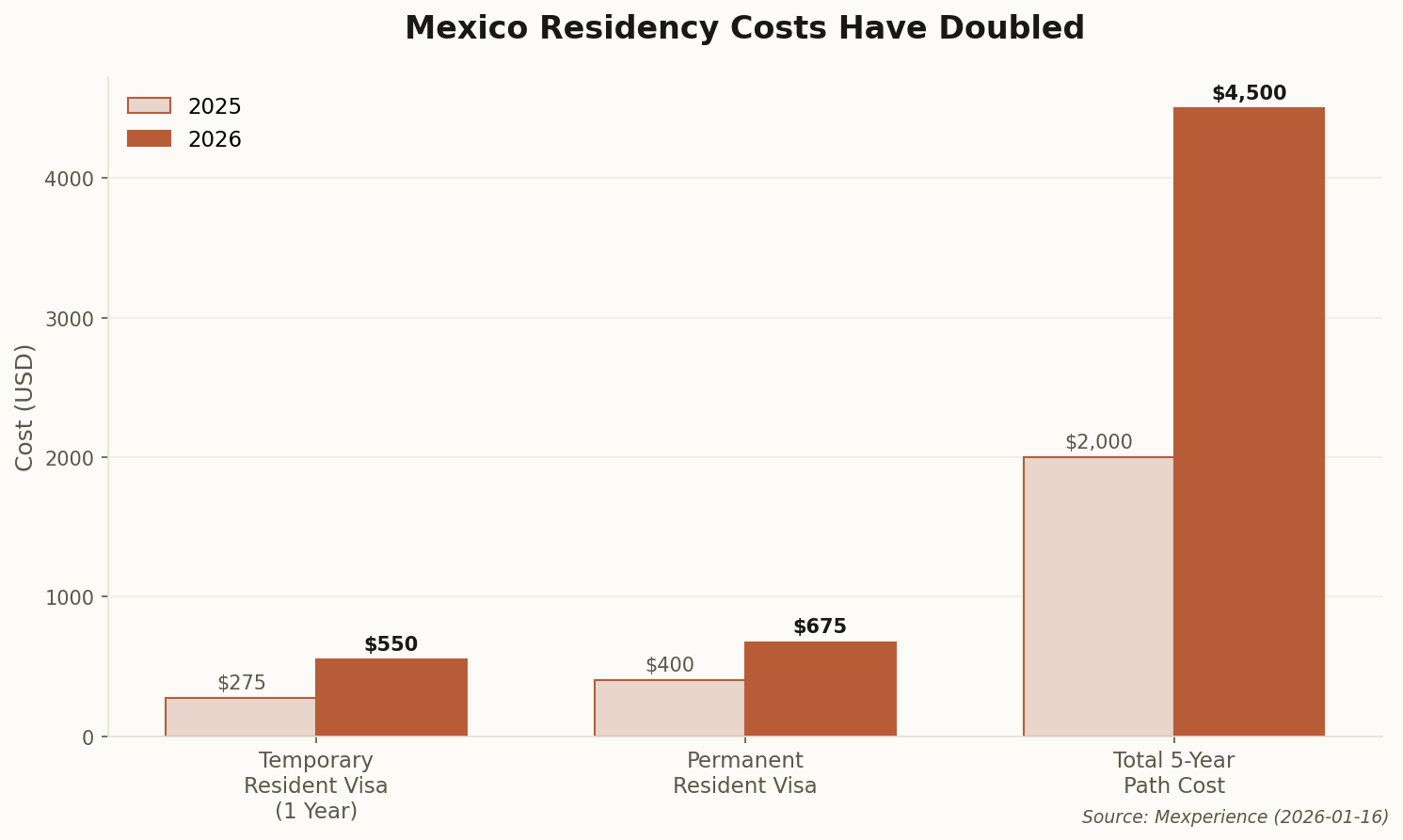

Mexico Just Made the American Dream More Expensive

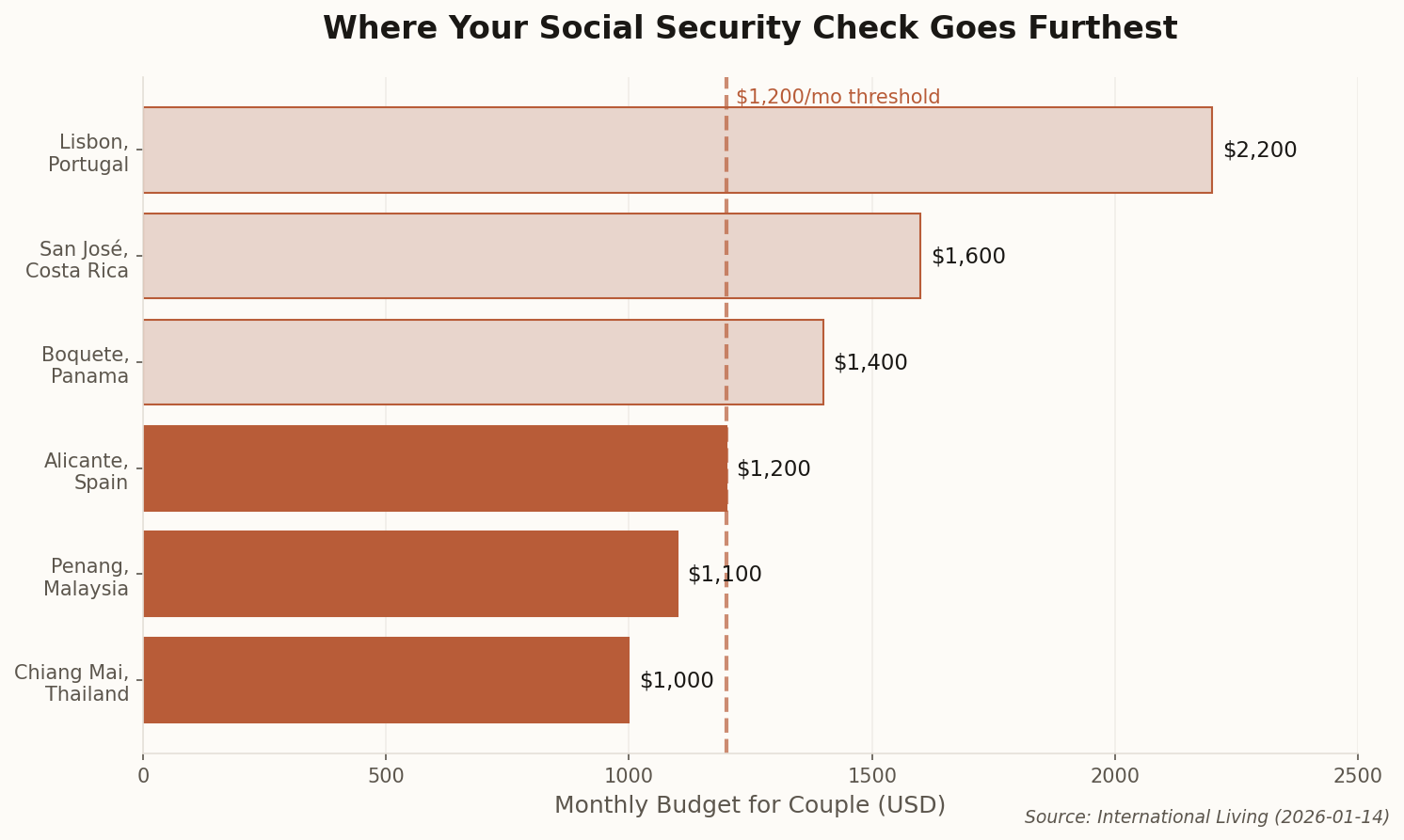

If you were planning to retire to Mexico on a modest budget, you just got priced out of the first-class line. Effective this month, the Mexican government has more than doubled processing fees for foreign residency visas. A one-year Temporary Resident Visa now runs about $550 USD, up from roughly $275. The five-year journey from temporary to permanent status? That'll set a couple back an estimated $4,500 in fees alone—double what it cost twelve months ago.

The financial solvency requirements got tighter too. Mexico now uses a higher UMA baseline to calculate whether you're wealthy enough to deserve residency. Translation: you need to prove more income or savings than before. This isn't xenophobia—it's economics. San Miguel de Allende and Puerto Vallarta have become so popular with Americans that housing costs have spiked for locals, and the government is responding with market-based friction.

The irony: this will likely push budget-conscious retirees toward Central American alternatives, potentially repeating the cycle in Guatemala or Nicaragua. Watch those visa programs next.