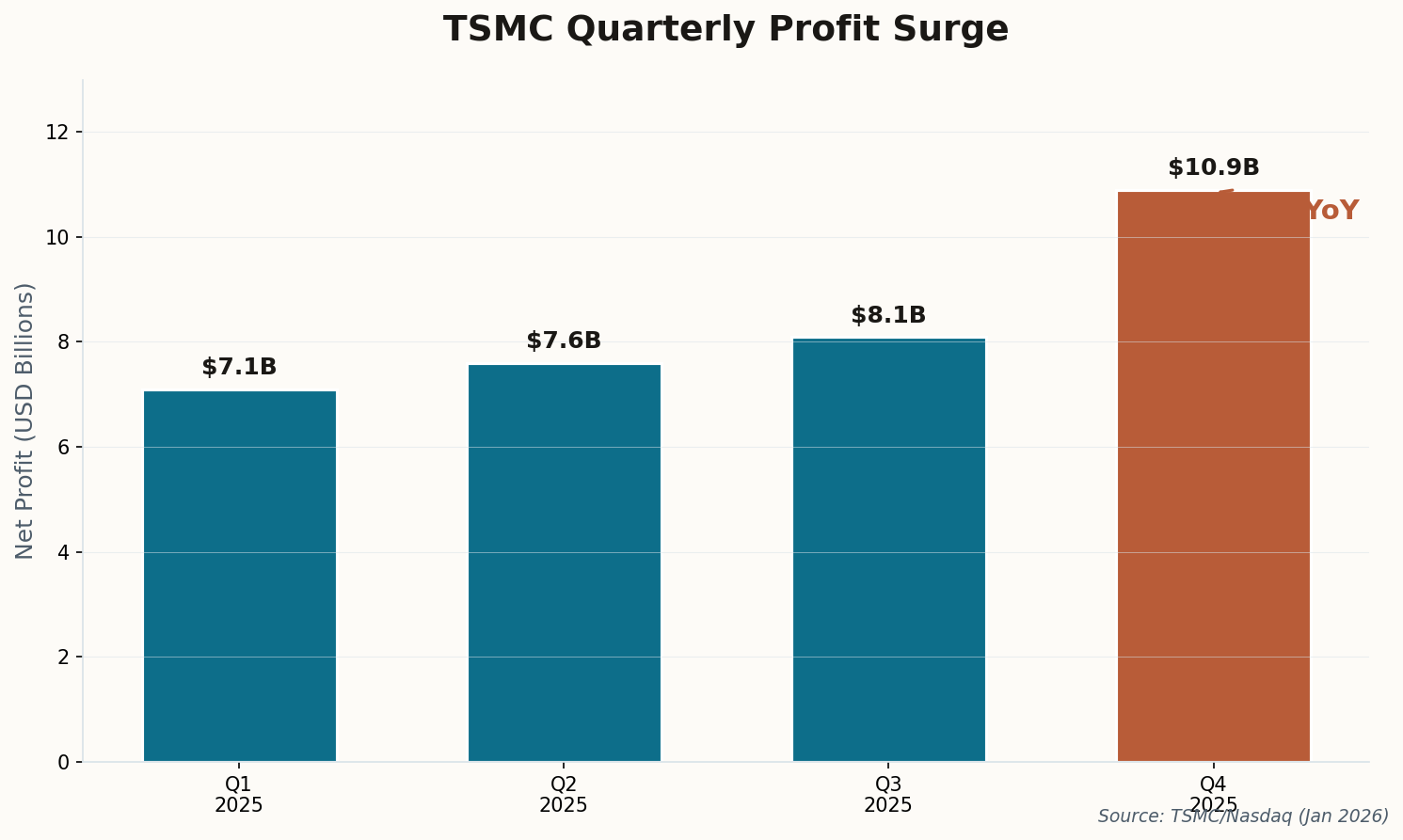

AI Chips Are the New Oil—And TSMC Just Proved It

While Washington debates tariffs and the Fed wrestles with inflation, Taiwan Semiconductor Manufacturing Co. just reminded everyone what's actually driving this economy. A 35% jump in quarterly profit doesn't happen by accident—it happens when every major tech company on earth is scrambling to secure capacity for AI workloads.

The ripple effect was immediate: Nvidia and AMD rallied hard, pulling the entire semiconductor index with them. This single earnings report recovered most of the mid-week market losses caused by inflation jitters and Fed uncertainty.

The bigger picture: The US economy in 2026 is increasingly bifurcated. The tech sector—particularly anything touching AI infrastructure—operates in a different gravitational field than traditional banking, retail, or manufacturing. This divergence will only accelerate.