DeepSeek Drops a Bomb on AI Economics

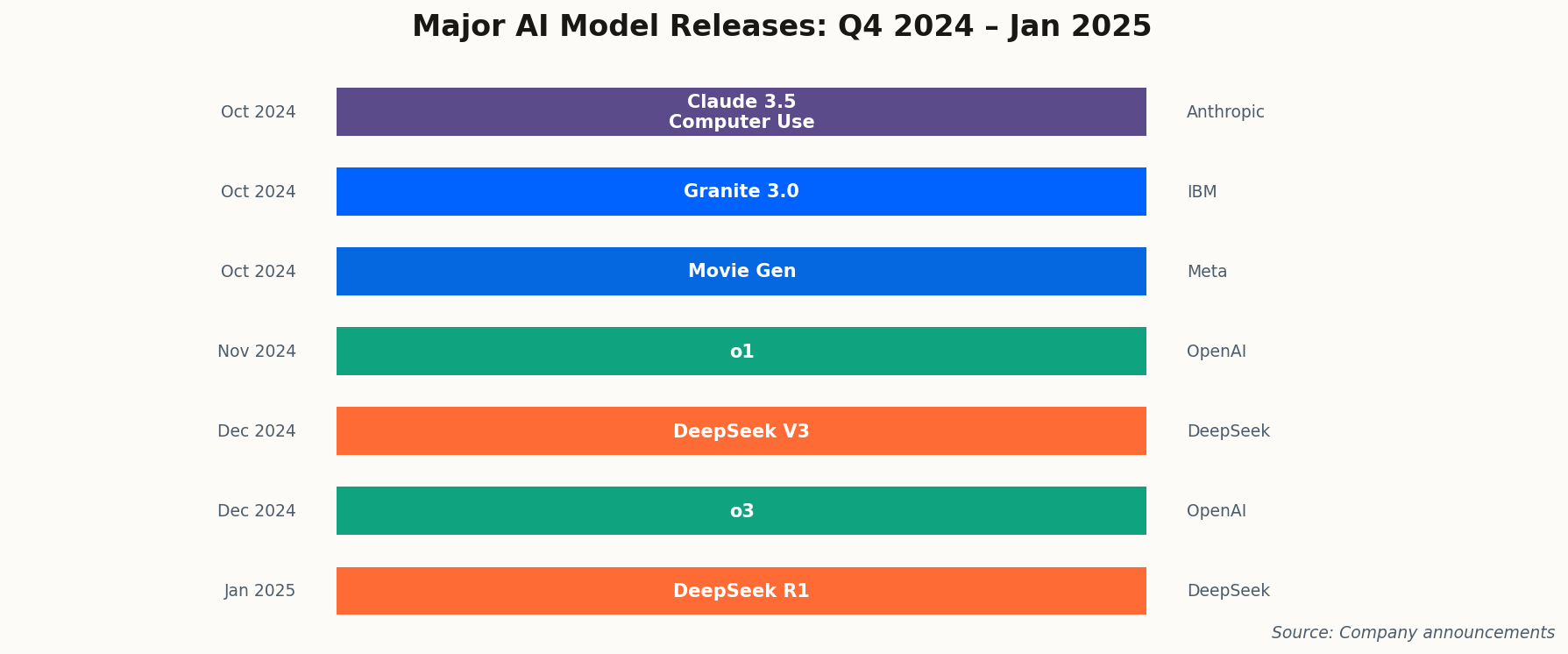

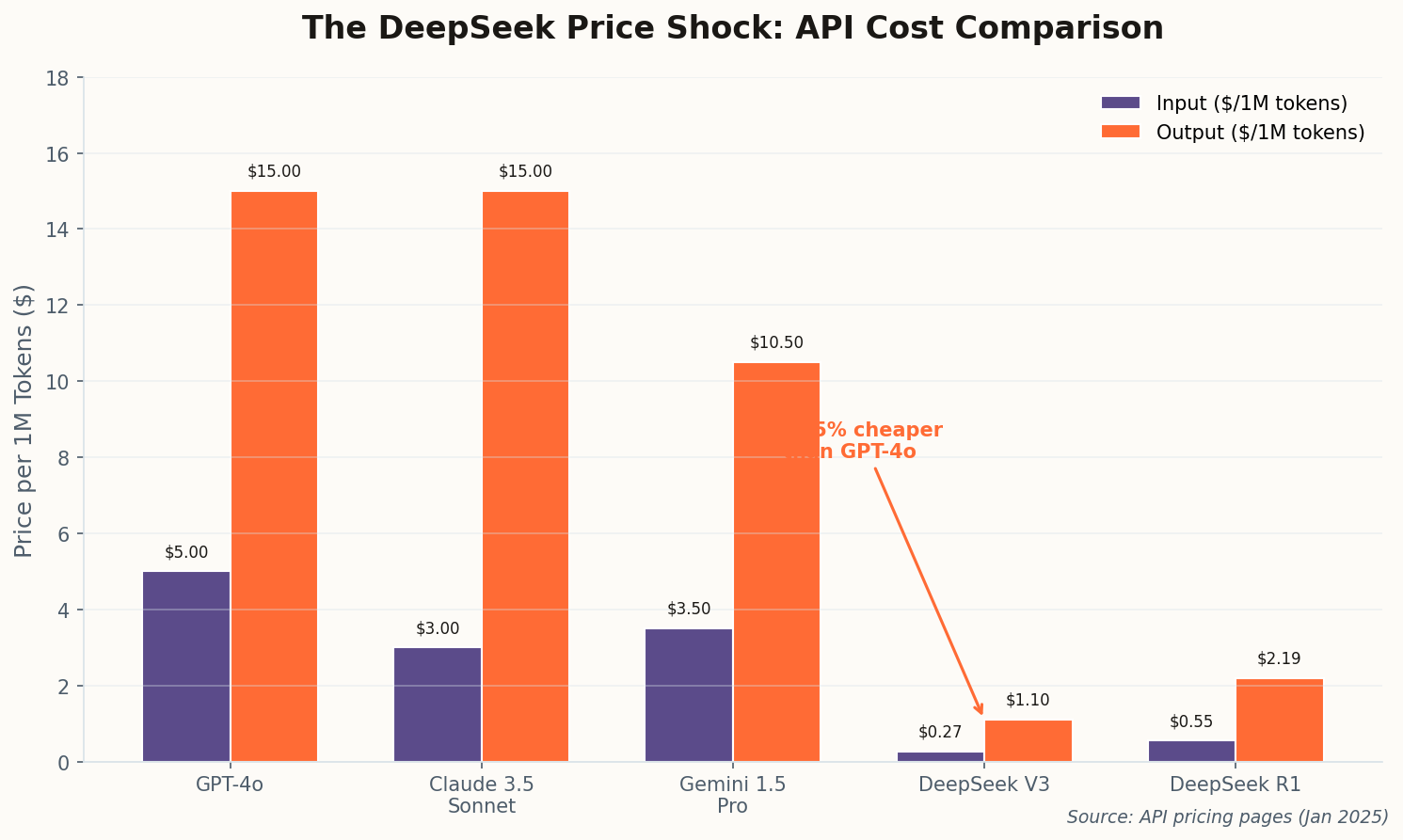

A Chinese startup just did what Silicon Valley said was impossible. DeepSeek released V3 and R1—models that match OpenAI's GPT-4o performance at roughly 5% of the cost. The market noticed: Nvidia shed billions in market cap as investors suddenly questioned whether more efficient software might reduce hardware demand.

R1 introduced "reasoning" capabilities similar to OpenAI's o1—but as an open-weights model anyone can run. The geopolitical implications are staggering: state-of-the-art AI is now accessible without US-centric infrastructure or budgets.

The signal: "DeepSeek represents the first credible threat to US hegemony in the foundation model layer." The commoditization of intelligence has begun.