The Magnificent 7 Lose Their Grip

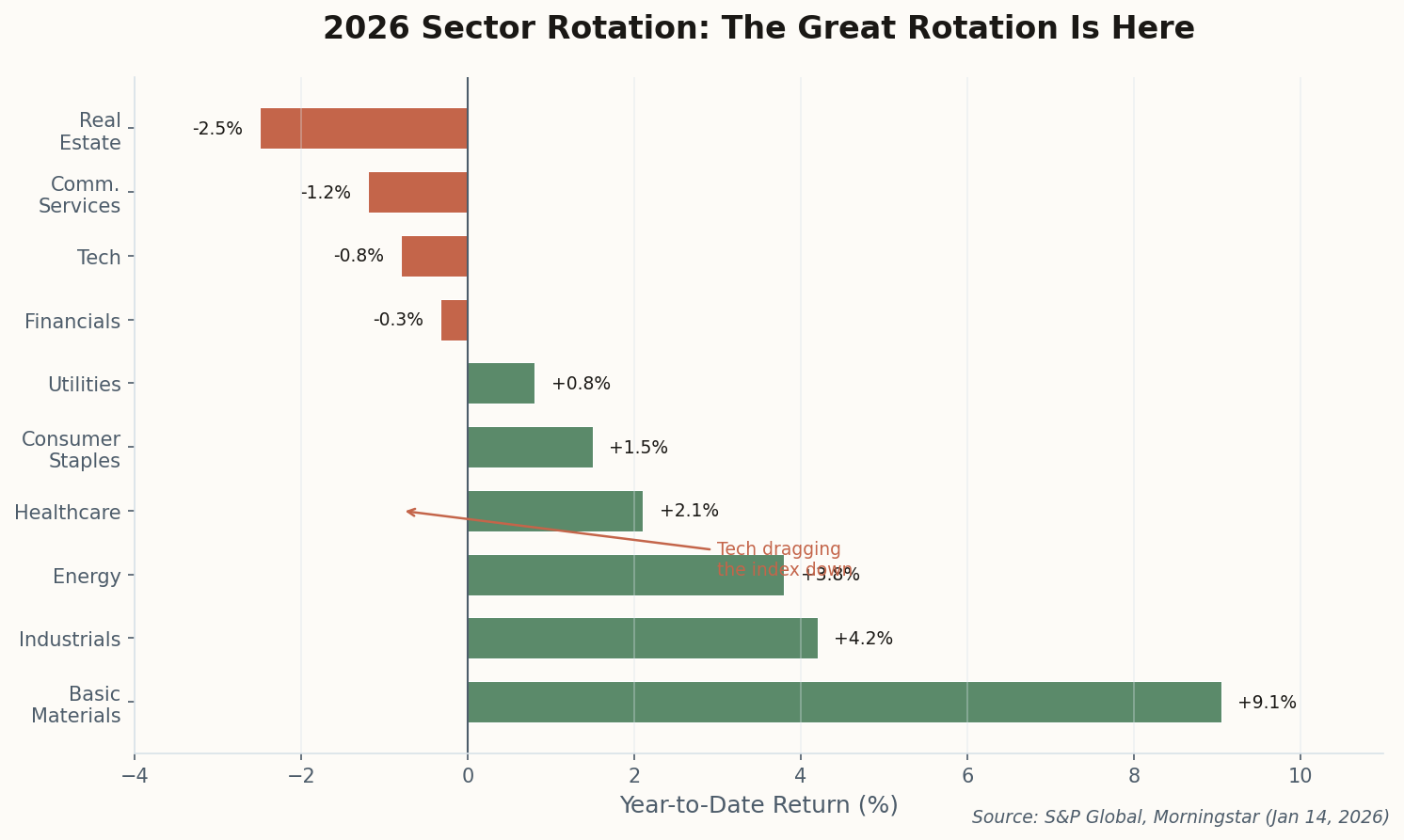

Something strange is happening in early 2026: the stocks that carried the market for three years are now dragging it down. Five of the seven mega-cap tech giants sit in negative territory through mid-January, and the S&P 500 is up just 0.7%—a far cry from the index's usual tech-powered surge.

The numbers tell the story. Nvidia, Apple, Microsoft, Meta, Alphabet, Amazon, and Tesla still account for more than 35% of the S&P 500's total weighting. When they stumble, the index stumbles. And right now, they're stumbling.

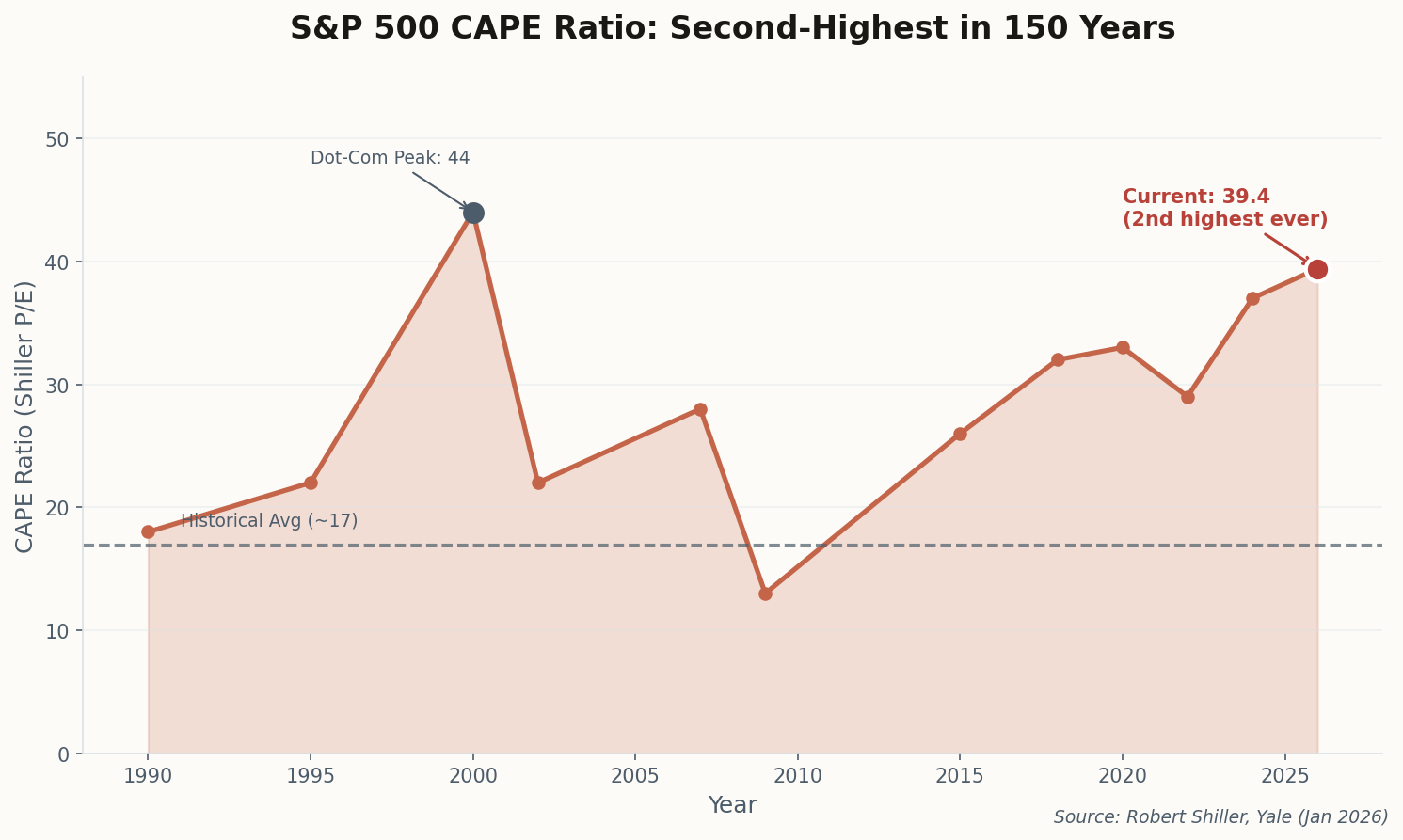

The earnings outlook partly explains the malaise. Magnificent 7 profits are expected to climb about 18% in 2026—respectable, but the slowest pace since 2022 and barely better than the 13% rise projected for the other 493 companies. The era of exceptional growth is normalizing, and prices haven't fully adjusted.

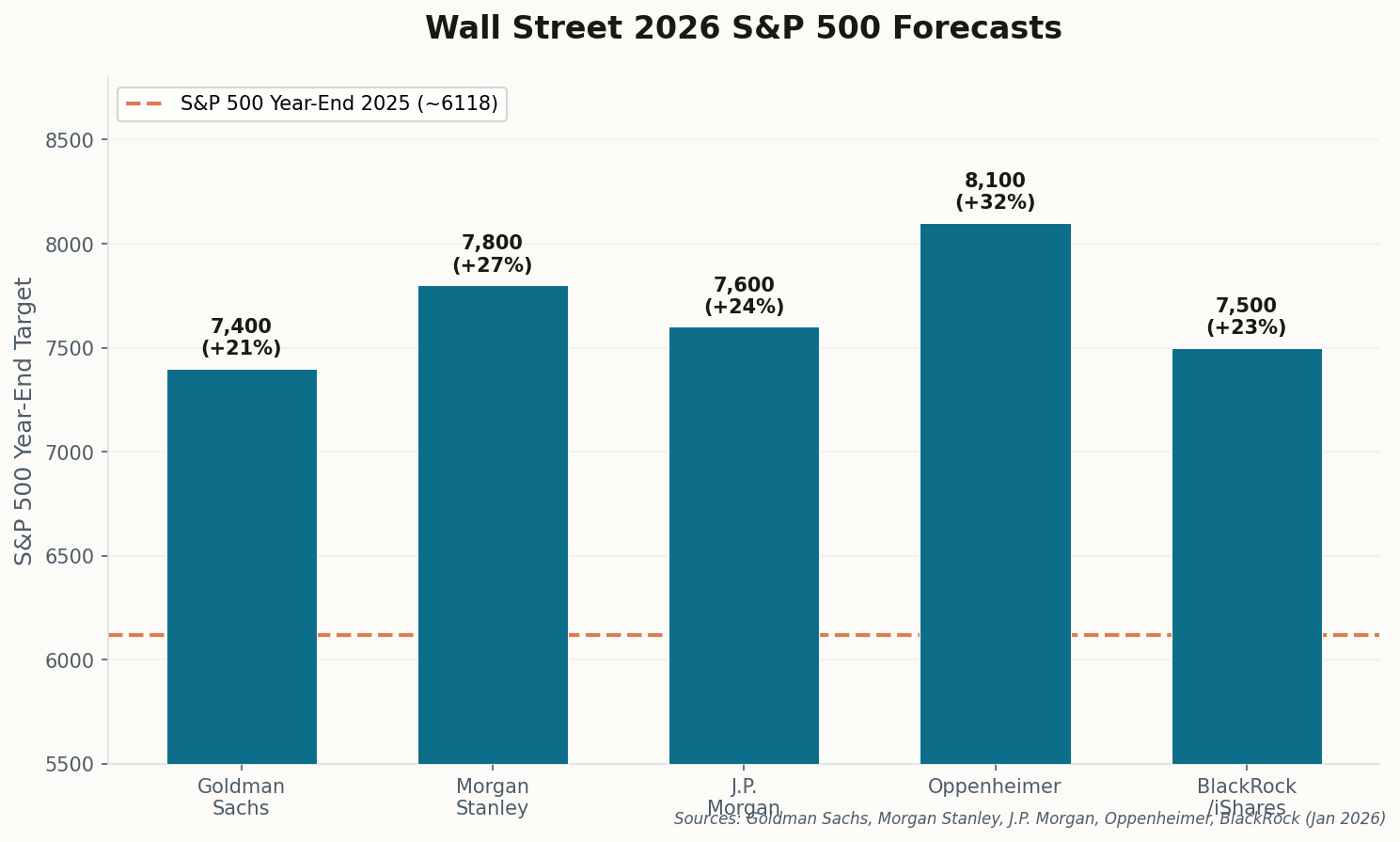

Key takeaway: Former Cisco CEO John Chambers predicts 2026 will be "a year of divergence" within the Magnificent 7. Translation: pick your horses carefully.