The Magnificent 7 Stumble Out of the Gate

Two weeks into 2026, and the market's engine is sputtering. Five of the seven mega-cap tech stocks that drove the S&P 500's rally are now in the red: Nvidia, Apple, Microsoft, Meta, and Tesla have all slipped. Only Alphabet and Amazon are bucking the trend.

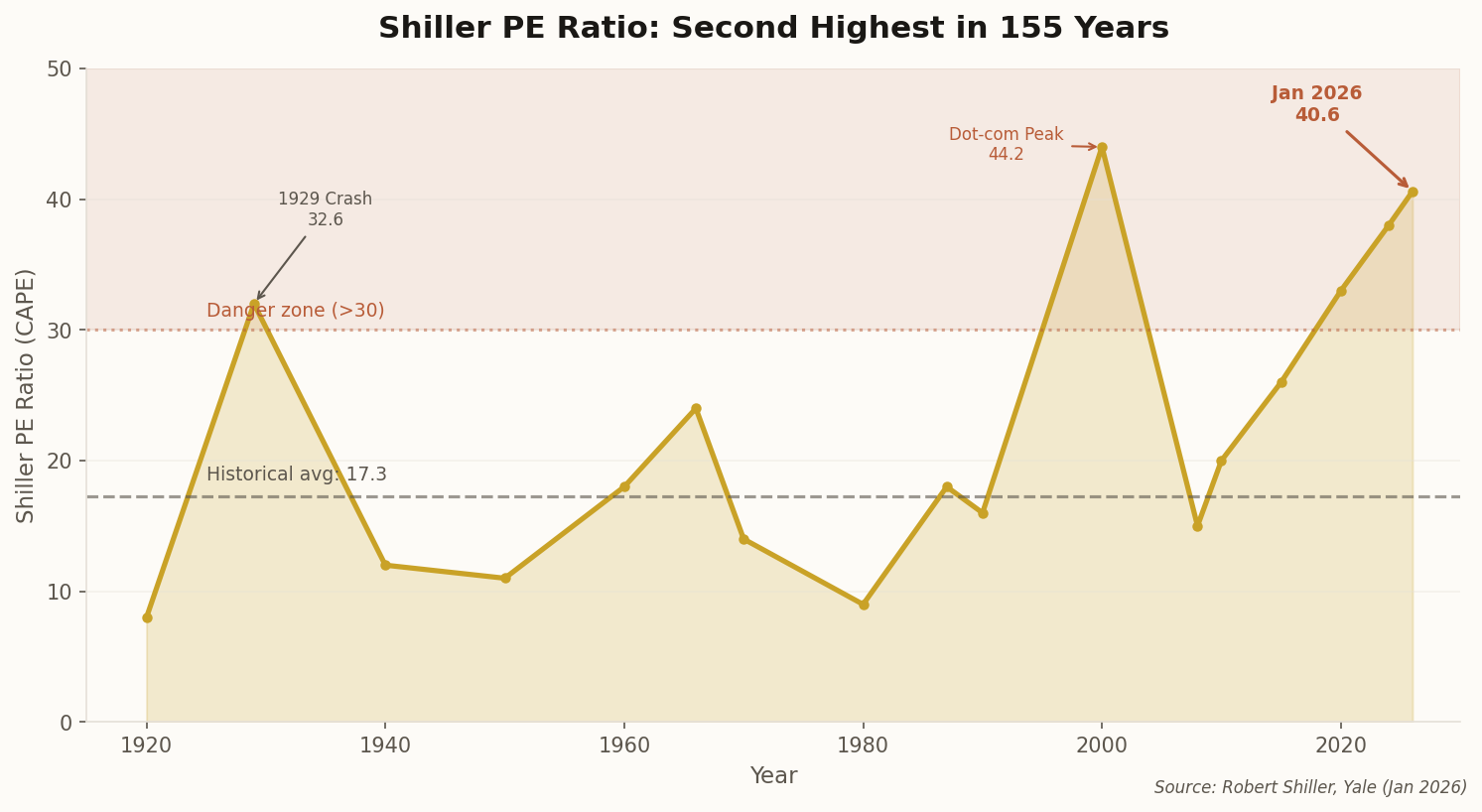

The Magnificent 7's collective momentum appears to be fading, and the elite group is now acting as a drag on the broader market rather than its engine. Profits for the group are expected to climb about 18% in 2026—the slowest pace since 2022 and not much better than the 13% rise projected for the other 493 companies in the S&P 500. The "earnings exceptionalism" that justified premium valuations is converging toward the mean.

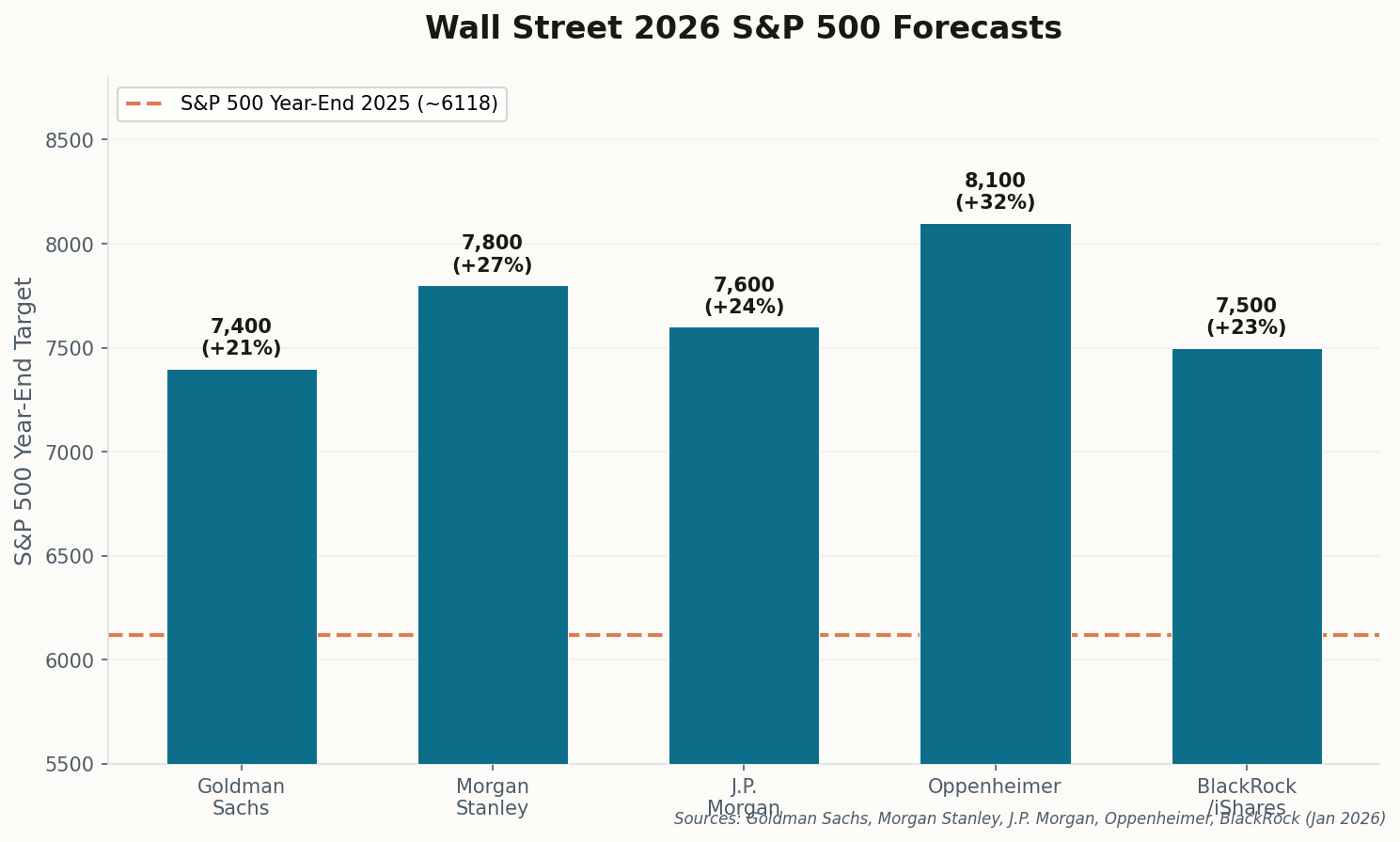

Former Cisco CEO John Chambers believes 2026 will be a year of divergence within the group. Wall Street's favorite for the year? Nvidia. The least loved? Tesla and Apple—the former facing stagnant revenue growth, the latter lacking visible AI leadership despite trading at 31x earnings.

The hierarchy shift: Wall Street projects big gains for Amazon, Meta, and Microsoft. Apple attracted pessimism from business leaders who pointed to departing executives and a mature product line. One AI founder said of Nvidia CEO Jensen Huang: "I'd rather be in Jensen's seat than anywhere else."