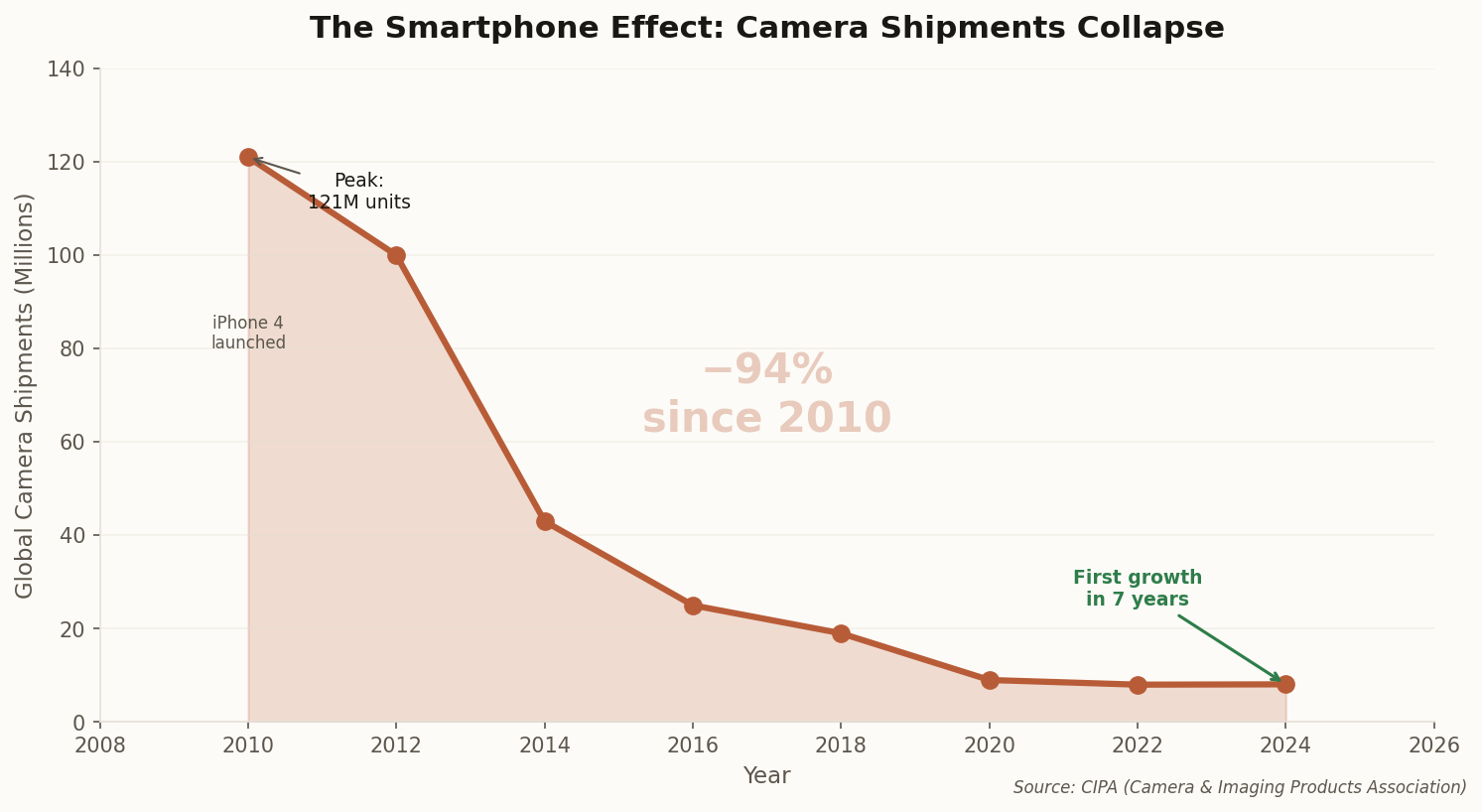

First Growth in Seven Years: The Market Stabilizes

After nearly a decade of freefall, the dedicated camera market posted its first year-over-year growth since 2017. Global shipments hit 8.07 million units in 2024, up 14% from 7.08 million in 2023. It's not a boom—it's a floor. The market has finally found the audience that smartphones can't replace.

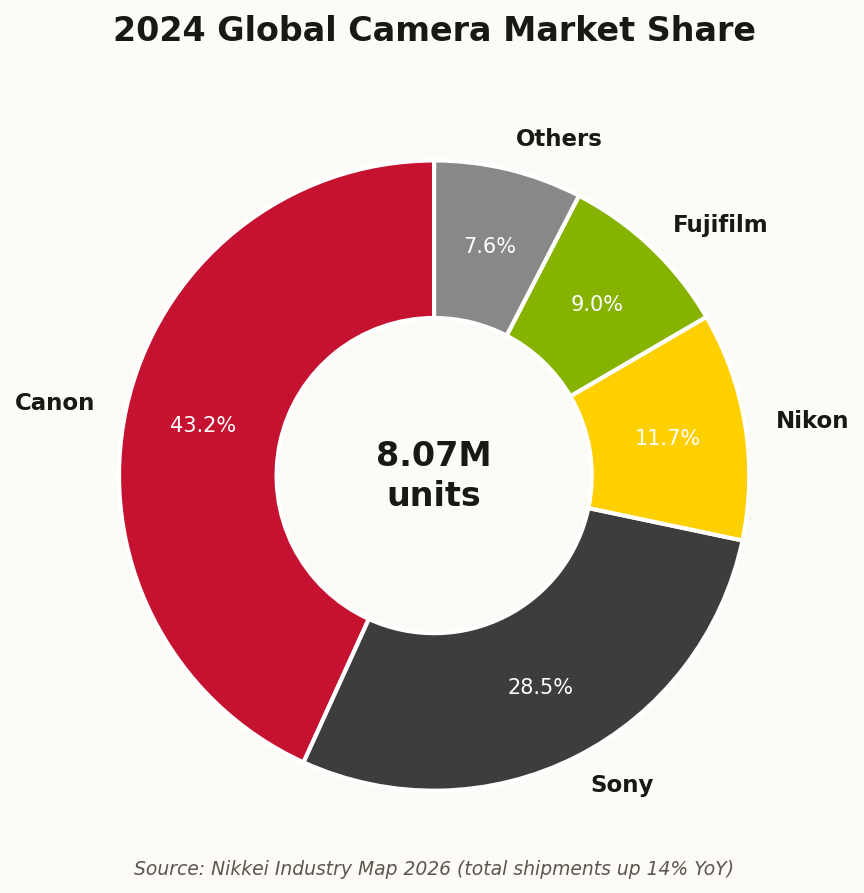

Canon dominates with 3.53 million units shipped, maintaining its 43% market share through aggressive product releases and a full-frame strategy that spans entry-level to flagship. Sony holds second at 28.5% with 2.33 million units, while Nikon takes third at 11.7%. The real story is Fujifilm: they jumped from 430,000 units (6% share) in 2023 to 740,000 units (9% share) in 2024—a 72% increase driven almost entirely by one camera.

The segment breakdown: Mirrorless bodies lead with 57.85% share and 6.23% CAGR. APS-C sensors dominate unit sales (65% of market) due to affordability, while full-frame commands 37.25% share with higher revenue per unit. Medium format remains niche but growing among professional creators.